With a great many investment portfolios down 15% or so, what can retirees do to make up for that lost source of income?

Now that COVID-19 has officially changed everything, let’s talk about how you can maintain as much of your retirement income as possible.

The combination of factors we have witnessed is almost overwhelming.

- The stock market is down 20% to 30% from the beginning of the year.

- The bond market is flat or down and not offsetting the stock market losses.

- The yield on 10-year Treasuries is down to below 1%.

- Taken together, a typical IRA or 401(k) account is down 15%.

If you were planning on drawing down your savings at the rate of, say, 4% a year — or $40,000 on a $1 million IRA — your withdrawal is also down 15% to $34,000. Or if you were counting on dividends or interest as your main source of income from your personal savings, the underlying securities are depressed and could be at risk.

How much income can you count on?

All of this bad news means that the income you were counting on other than Social Security, any pension, or annuity payments you were already getting, is under pressure. So, if you’re already retired, or about to retire (voluntarily or not) you likely have a big hole in your budget. That hole could be growing larger every day if your income was mostly coming from withdrawals, like RMDs from your 401(k) or rollover IRA, since they decline directly with the fall in account values. (The dramatic fall in market values since year end points out the general problem with RMD withdrawals, which are based on year-end values but could be taken from an already depressed account.)

Depending on your income sources, your income hole could be $10,000, $25,000 or $50,000 per year, or even more. And it’s unlikely you can or want to go back to work to fill that hole. So, what are the things you should consider as you determine how to climb out?

In short, your plan should focus on actions you control rather than those you can’t.

Six ways to take control of your retirement

1. Create a plan for retirement income

Most importantly you should have a plan for retirement income. It doesn’t have to be elaborate, but it should be recorded and updated at least annually, and should guide your decisions going forward. The plan should be about income and follow an Income Allocation model, a strategy that for your IRA or 401(k) savings combines a mixture of annuity payments with a tax-smart and managed IRA/401(k) withdrawal plan. (After all, focusing on the allocation of your savings and selection of individual securities didn’t prevent the income hole from forming.)

For more on how this Income Allocation model works, please read A Different Kind of Diversification Pays Off for Retirees.

2. Generate more income

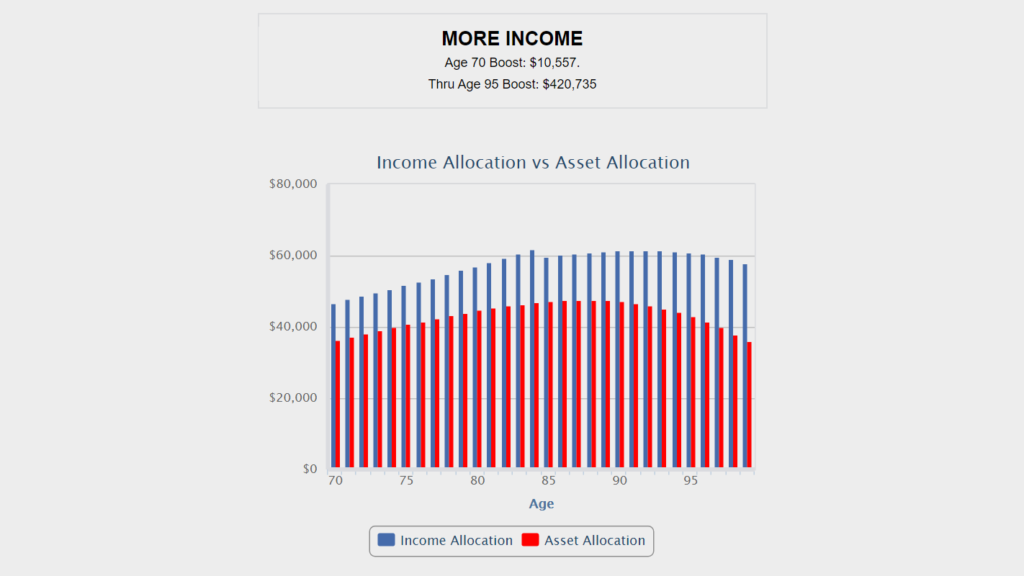

Asset withdrawals from IRA or 401(k) savings using the Required Minimum Distributions formula are a little under 4% at age 70. This is what many advisers recommend as a way to tap your savings. There is an alternative in Income Allocation planning that starts with higher income that grows over time. The chart below shows the year-by-year income boost you can get just from your IRA by adopting an Income Allocation plan (what we call IRA2Income), rather than an asset withdrawal/RMD strategy. That’s because Income Allocation provides higher income from lifetime annuity payments that are guaranteed and not affected by market conditions.

3. Build in more security

A large percentage of 401(k) participants invest their savings in target date funds that automatically reduce risky holdings in their account as they near retirement. Once they retire, increasing income from annuity payments can provide similar security — guaranteed income for life no matter how long you live. Research shows that consumers generally do not reap the rewards of most stock market gains because they sell their holdings during bad times (like now) and are not invested when the market begins to climb again. A concentration on income, with a percentage of your retirement income coming from annuity payments, relieves that pressure and allows you to stay the course in volatile markets.

Under a typical IRA2Income plan, 40% of your income is guaranteed in the first year and continues to grow over time. When added to Social Security, you might have 70% or more of your income free of market risk.

4. Lower your fees

During retirement, you’ll want to keep a portion of your savings invested in the market. Just make sure you invest in diversified, low-cost index funds, ETFs or direct indexing portfolios. These investments can be managed within an automated, or “robo-advisor” platform, to cut your fees in half or more. Robo-platforms can even suggest investment models and allow you to adjust those models if you choose.

When your objective is a plan for retirement income, think about the fees you’re paying as coming directly out of your income rather than out of your savings. With a full-service advisory fee averaging 1.00% of assets under management, they can represent a large percentage of your income.

For more on how to cut your fees, please see How to Cut Your Investment Fees in Half.

5. Lower your tax rate

Conventional wisdom says that when you generate more income, your tax rate will be higher, too. But your taxes are very much dependent on the source and composition of the income, and by following an Income Allocation approach on your personal savings as well, you can lower your retirement tax rate. For more on that, please see How to Lower Your Retirement Tax Rate to Less Than 10%.

One part of Income Allocation that works particularly well in today’s environment is the allocation to annuity payments starting immediately within your personal savings. Not only are these lifetime annuity payments five to six times the cash flow from, say, a long-term Treasury bond, these payments contribute very little, if any, to the calculation of your taxable income for the 15 to 20 years following purchase.

6. Minimize your stress level

Besides setting up a plan that is less dependent on the market, you can look for an adviser who can help manage your plan and make real-time adjustments to that plan to reflect changes in the market and your personal situation. The difference is this: You and your adviser are managing your plan, not just your investments. Using an adviser to manage your plan and a robo-adviser to manage your investments could be the perfect combination.

What is your Income Boost?

The chart below compares an Income allocation plan for your IRA or 401(k) savings (IRA2Income) with an asset withdrawal/RMD plan. The example is for a 70-year-old male with $1 million in savings, considering a robo-advisor investment platform under either plan.

The first-year boost is $10,500 under Income Allocation, and the total income boost through age 95 is over $420,000. Both assume a modest stock market return of 6% and current market interest rates. These are boosts you can realize with a combination of well-planned annuity payments and low-fee investments, following an Income Allocation planning method.

Every Income Allocation plan is specific to the investor but if you would like to see what your Income Boost would look like from savings in your Rollover IRA or 401(k), click here and fill in 100% to Rollover IRA. If you’d like to see the boost for your total savings, fill in the percentage allocation to Rollover IRA savings.

Go2Income addresses the financial retirement issues you are facing now and will continue to face in the future. To learn more, visit Go2Income here.