Ever since the IRS released regulations in July 2014 about QLACs (defined below), I’ve been making strong and positive statements about this new investment vehicle. I’ve stated that it’s “the most important change in retirement plans since the 401(k) was invented,” and “every Baby Boomer with retirement savings will need to consider a QLAC as part of his/her plans for retirement income distributions.”

Ever since the IRS released regulations in July 2014 about QLACs (defined below), I’ve been making strong and positive statements about this new investment vehicle. I’ve stated that it’s “the most important change in retirement plans since the 401(k) was invented,” and “every Baby Boomer with retirement savings will need to consider a QLAC as part of his/her plans for retirement income distributions.”

These statements are in stark contrast to those who suggest that a QLAC is simply a way for high net worth investors to defer taxes on retirement distributions they don’t need.

Over the coming months, I intend to write about QLACs, provide real-life examples, and describe the QLAC marketplace, all with a goal to educate readers about QLACs. But for today, let’s start with this introduction to QLAC so that you can understand the significance of what’s to follow in coming months.

What is a QLAC?

The IRS published regulations in July, 2014, that define a QLAC as a “Qualified Longevity Annuity Contract” and that provide its special tax treatment. Specifically, a QLAC can be purchased from an IRA as well as from a 401(k) and other qualified retirement plans.

Think of a QLAC as a deferred pension purchased with a portion of your retirement savings providing guaranteed lifetime income starting at an age you choose (but not later than age 85). Before this deferred pension begins making regular monthly income payments, there are no required minimum distributions (RMDs) and thus no current taxes to pay.

While many life insurance companies will eventually offer QLACs, because of the long-term and critically important nature of the contract, a QLAC should be purchased from highly rated insurance companies. As such, it should be considered a conservative part of your retirement investment portfolio, like a highly rated bond or mutual fund portfolio.

Why did the IRS adopt regulations permitting the QLAC?

I believe the IRS got it right in issuing the QLAC regulations, but even they may not have fully understood the fundamental changes in retirement planning that QLAC will produce.

Here’s what the IRS press release said about the rationale for QLACs: “All Americans deserve security in their later years and need effective tools to make the most of their hard-earned savings. As Boomers approach retirement and life expectancies increase, longevity income annuities can be an important option to help Americans plan for retirement and ensure they have a regular stream of income for as long as they live.”

When and why does a QLAC make sense? How much can an investor contribute?

Typically, a QLAC makes sense if the investor is in good health, between ages 55 and 75, and currently has a retirement account balance of $100,000 or more. Also, the investor must be able to support current and projected retirement expenses without needing access to the premium used to purchase the QLAC.

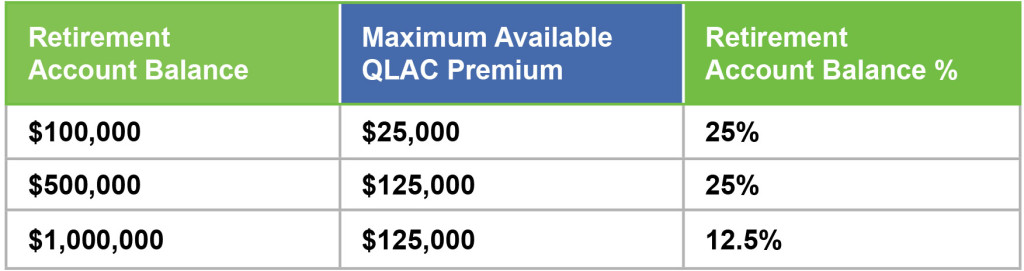

The maximum contribution is 25% of your eligible retirement account balance(s) or $125,000, whichever is less. The chart below shows the maximum amount an investor could invest in a QLAC.

In addition, the regulations allow for addition contributions to a QLAC when either account balances grow or the $125,000 limit is increased because of inflation. More about that in later articles, but if you want a clearer picture of the impact a QLAC would have on your specific investment portfolio, visit our Go2Income Toolkit to explore your options.

Annuities have an image problem: The bad, the good, the misunderstood

[…] you can buy more income to start in the future. One form of deferred income annuity, called a QLAC, purchased out of a rollover IRA, has unique tax […]

Planning with Certainty: Combine QLAC and LTC insurance

[…] financial products, a Qualified Longevity Annuity Contract (QLAC), and Long Term Care insurance (LTC), are both designed to protect you against late-in-life […]

Rely on accurate numbers -- not your gut -- for better retirement decisions

[…] discussion on this topic with a woman who had visited the Go2Income.com website and decided that a QLAC might be a good addition to her retirement plan. She learned that a QLAC is a deferred income […]

Kiplinger's recognizes QLAC value for retirement savings

[…] I wrote in the blog post QLAC Introduction, “the IRS published regulations in July 2014 that allow savers to use a portion of their rollover […]