For all the saving and planning you do to prepare for retirement, there remain two questions that are impossible to answer about the strength of your plan:

- What will the stock market do during my retirement?

- Will I outlive my savings?

A lot of planning expresses those risks like this: “Under our Monte Carlo analysis, you have a 90% chance that your money will last until age 90.” Or if you’re more sophisticated, they’ll give you a plot point like the following and then ask you to select the best set of outcomes.

There are two problems with these approaches:

- The plan itself is shifting the wrong risk to the retiree, i.e., running out of money.

- The decision mechanism is too complex and too scary for the average retiree.

There is an alternative. A sensible retirement income plan can handle both market risk and longevity risk. In a down market, you can still have plenty of income; in case you live beyond your life expectancy, you will still have income; and in case of your early passing, your heirs will still get some inheritance.

Step 1: Learn about income Allocation

As important as the quality of the plan is the kind of information provided when you make your decisions. As the graphical information below shows, you can make an informed, educated choice. To illustrate, we ran the numbers for a new female retiree aged 65 with $1 million of savings, of which 50% is in a traditional rollover IRA. She began her exploration in Step 1 by reading the FAQs about the Income Allocation planning (IAP) method.

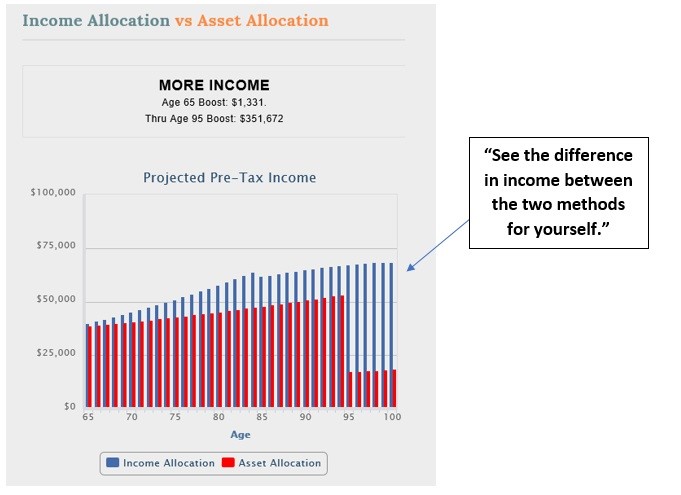

Step 2: Compare a basic IAP with traditional planning

Next, put in your own numbers and analyze the results of a plan that provides retirement income for life, no matter how the market behaves. The graphic below shows results for the woman in our fictional example.

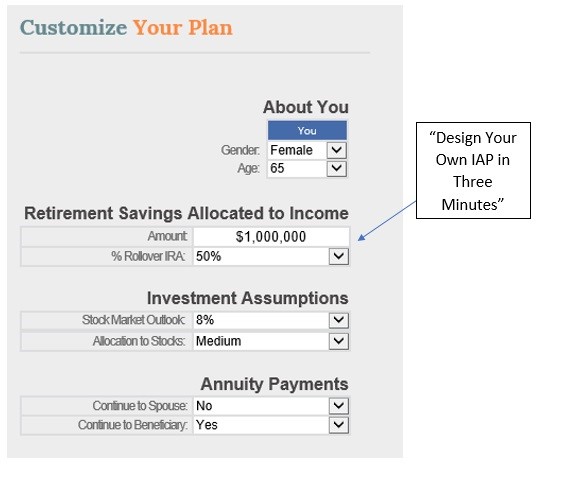

Step 3: Customize Your IAP

Income annuities, guaranteed by highly rated insurance companies, protect you from outliving your savings. Some of your savings will also remain in the markets, with dividends and interest providing another source of income.

Figuring out how to allocate income among these sources on your own can be challenging.

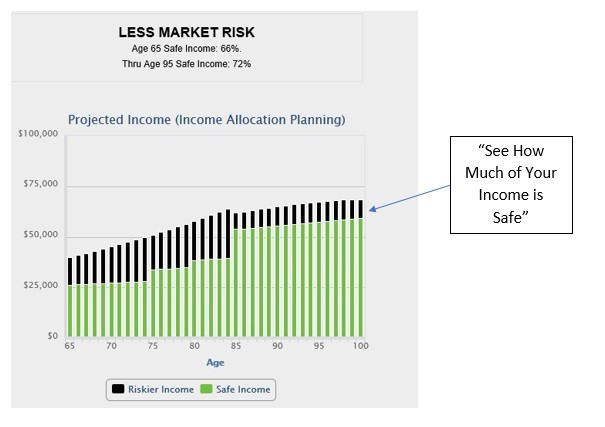

Step 4a: See the Results of Your IAP – Safe vs Riskier Income

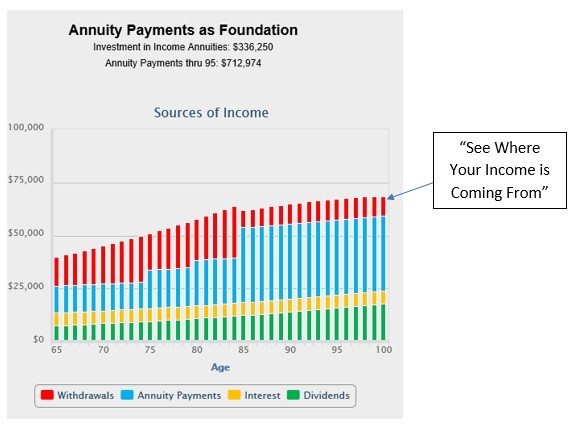

They say a picture is worth a thousand words, so the next thing is to look at a picture of your income.

See where it starts, how it grows, how much is safe and where it’s coming from.

Step 4.b: See the Results of Your IAP – Sources of Income

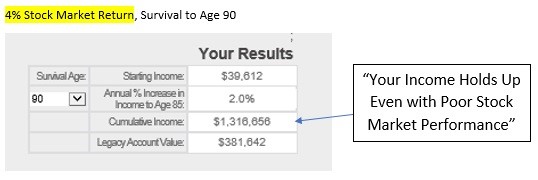

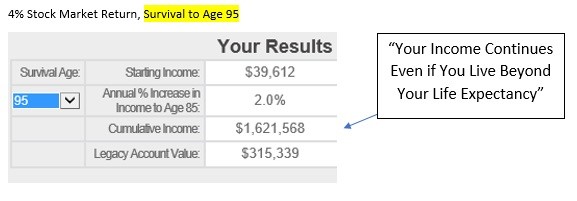

Step 5: Stress Test Your IAP

You can examine different scenarios – longer life, worse market – to see how things might develop. As you will see, no matter how you stress an income allocation plan, your retirement works out. Even when the long-term market return is only 4% (which would be in the lowest 10th percentile historically) your income will barely budge.

Note that the amount going to your beneficiaries will be significantly lower. But at least you won’t have to move into their extra bedroom because you have run out of money. And if you live beyond your life expectancy, your income will still be there even with poor market performance.

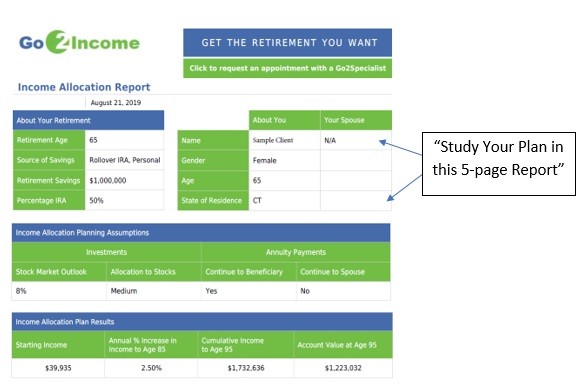

Step 6: Order a Report

To get the nitty-gritty of your plan order a report which will show information in greater detail.

You’ll be able to review on your own or with another person you trust.

Step 7: Talk to a Go2Specialist

After you order your customized five-page report, our Go2Specialists will spend another hour with you – at no charge – discussing how you can further customize your plan to give you and your family the most important retirement gift: Peace of mind.

They have tools to refine your plan to balance your competing objectives, like starting income, legacy, or increases in income. They can increase or decrease the allocation to annuity payments.

Do you want to explore on your own? Go to income allocation and create your own plan. If you have more questions, write to Ask Jerry and I will answer you myself.