Find calmer seas with a retirement plan that includes safe income and eliminates the sour stomach that comes with market corrections.

In response to the wild market swings caused by inflation and Russia’s attack on Ukraine, most investment advisers are publishing articles about staying the course during volatile times. I’ve found one problem with these suggestions, particularly when it comes to investors near or in retirement: The advice is focused on your investment allocation, when your own focus most likely will be on your income, now and in the future. You don’t want a small — or worse yet, a large — market correction to wipe out your plans for income along with what you want to spend it on.

So, my question is: How much of your current and future retirement income should be dependent on the stock market — no matter whether it is heading up or down at any given point?

Answer: Design a plan for retirement income and you’ll find your safe harbor.

How to think about market volatility in a plan for retirement income

People like you who are thinking a lot about retirement generally fit into three stages:

- Planning to retire in five to 10 years and wondering about whether and how to reposition your savings during the homestretch.

- About to retire and ready to implement the final pieces of a plan that looked pretty good over the past few years.

- Already retired with a plan that has done well for the past several years — but nervous about the effects of the latest market volatility.

When you put together your own plan for retirement income you want your income to: (a) meet your current needs, (b) grow over time, and (c) last your lifetime. And you may want to leave a specific legacy at your passing. Finally, while often not discussed, you want a plan with a long-term view that will also reduce the anxiety that comes with stomach-churning drops in the market.

In retirement, the No. 1 concern is running out of money, so although you want the potential upside of the market, you also want to avoid big gambles. The result should be a plan that includes stocks, while also relying on income from safe sources to balance out the markets’ rough rides.

A Strategy to Weather Market Crashes

The goal is simple: You don’t want to be forced to change your lifestyle because of a downturn in the market, or even from a large, unexpected expense. Cutting back during retirement feels just like it does when you were employed: rotten. So, here’s our recommended approach to building a plan for retirement income that can weather the storms:

- Create a plan that is built around income. Understand what happens to income when market volatility occurs.

- Make sure that a large percentage of that income is safe and not impacted by market swings.

- Soften the impact of market gyrations by making sure any income that is based on a withdrawal/sale of investment is from a balanced portfolio of stocks and bonds

- Actively manage your plan so that if there is that market correction you are able to make minor adjustments to your planning objectives going forward.

What about that safe income?

Safe income includes:

- Social Security and pensions. You can count on both for the rest of your life. Social Security is adjusted for inflation, as are some — but not all — pensions.

- Dividends from a portfolio of high-dividend companies. No company is immune from market shocks, but you or your portfolio managers can select stocks that have demonstrated consistent and increasing dividends.

- Interest from a high-quality bond portfolio. Look for a diversified portfolio of corporate and municipal bonds.

- Annuity payments from income annuity contracts. Select from contracts that begin payments immediately as a foundation for your plan with deferred income annuity contracts used to create a ladder of increasing income.

Although “safe” income does not include IRA withdrawals managed as part of your overall income stream, a balanced portfolio of stocks and bonds smooths out the sharp ups and downs of market corrections.

A Case History

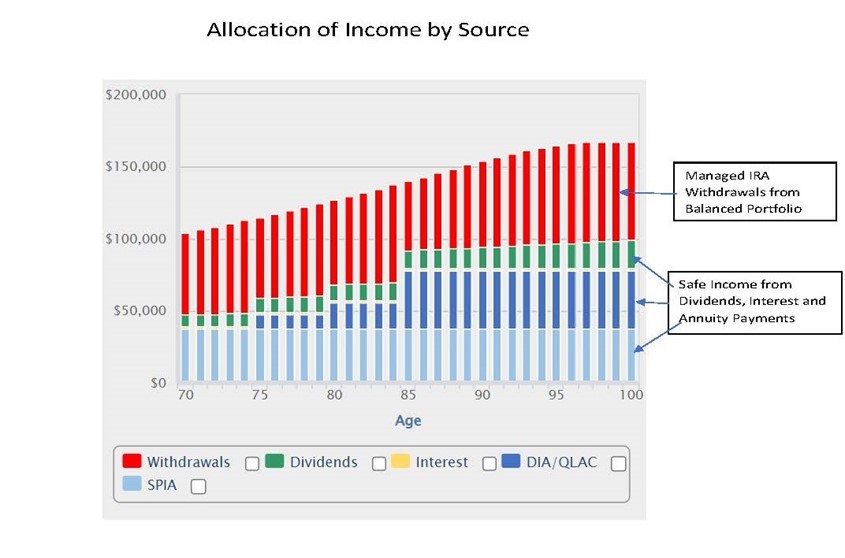

Let’s look at a retirement income plan designed for a 70-year-old woman who has $2 million in savings. You can see in the chart below that annuity payments are the foundation of her plan. Dividends and interest provide additional income, and IRA withdrawals are also a significant part of her income. (This particular strategy is designed to improve after-tax income and her legacy.)

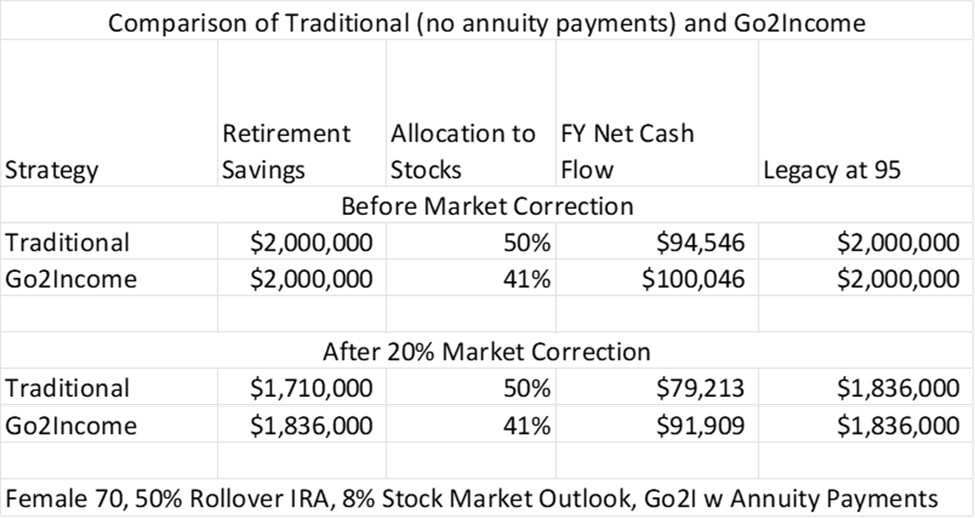

Now compare her income projections with and without immediate or deferred income annuity (DIA/QLAC) payments, and before and after a 20% market correction.

As you see, before the market correction, our investor has a starting income of about $100,000 for a plan that includes annuity payments, and about $94,000 a year in a plan without annuity payments. Both plans are designed to produce a legacy of $2 million at her passing at age 95.

What happens if we compress a market correction of 20% into the day she implements each of these new plans? (Corrections of this magnitude have occurred but often take weeks if not months.)

- The plan without annuity payments feels the impact of the market correction much more dramatically, and while the income falls in both plans, the advantage for the plan with annuity payments is now $92,000 in annual income vs $79,000 for the traditional plan.

- Further, the plan with annuity payments can get back to the original income through a replanning process by assuming either a higher return as part of a market recovery, or a lower inflation rate.

- While not always correlated with stock market corrections, higher interest rates would make any small incremental purchases of annuity payments more attractive and further close the income gap.

- And despite the higher income, the plan with annuity payments would have lower taxable income because of the favorable tax treatment of annuity payments. (Learn more about how annuity payments reduce your taxable income by reading How to Lower Your Retirement Tax Rate to Less Than 10%.)

Today we face inflation and uncertainties caused by war in Europe. Tomorrow, it will be another storm. No matter what questions you have about the future, a good plan for income provides peace of mind as it guides you through rough waters.

If you are ready to start building a Retirement Income Plan for your specific circumstances, visit Income Allocation Planning a Go2Income. We will ask a few easy questions so you can design a plan that meets your objectives. Whether I have fully convinced you about the value of annuity payments or not, why not research on your own? Click annuity info to compare your annuity payment and tax benefits with our investor’s results in the article.