From higher prices and mortgage rates to AI planning our retirements: These are some of the conversations you might have as multiple generations gather for the holiday.

The joy of the holidays means gathering everyone around the dining room table. Three or more generations might get together at this time of year and no other. We have a chance to catch up and reacquaint ourselves with stories and companionship and maybe talk about topics that are best discussed in person.

One of my first articles for Kiplinger.com, 8 Financial Conversation Starters for Thanksgiving Table Talk, was a reverie in 2017 for what we could (mostly) be thankful for. My primary audience was then and continues to be the Baby Boomer and grandparent — now six years older but statistically in the Boomer age range of about 58 to 77.

In that article, I imagined three generations at the table with the Boomer grandparents in charge. (Not every grandparent can host the event because, of course, the in-laws are also vying for this honor.) And with the next generation in the wings, the Boomers are looking at a transition from not only cooking the turkey but from their lifestyle and finances. Yet, they still are ready to help the younger generations.

You might want to wait until the cranky uncle is engrossed in the football game, but don’t be afraid to bring up some important financial discussions while everyone is in one place.

Set out below is what has changed since 2017, along with a list of other possible Thanksgiving discussion points. You decide which ones are best to bring up during hors d’oeuvres, the main course, dessert or while Uncle Bob is napping on the couch.

New talking points

Prices have risen, as they almost always will over the course of several years. The difference is a post-pandemic fast and scary rise in prices that has changed the way we think about our economic security, which often centers on housing and paying for college, two costly pillars of modern life that are significantly more expensive now, as is the cost of living in general. Not only are homes pricier, but mortgage rates are up from 4.0% in 2017 to 7.44% now.

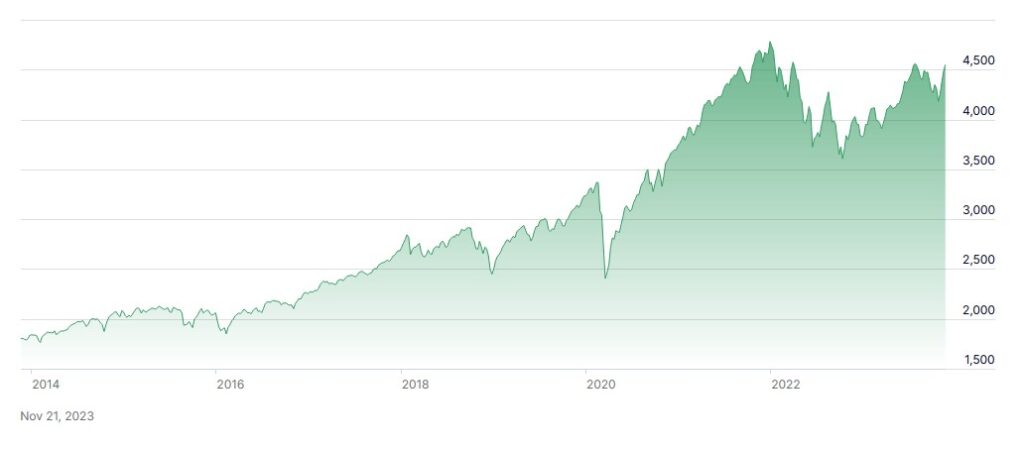

Funding these rising costs looks a little different, too, than it did in 2017. The stock market rose for most of the period until 2020, when it was underwater, but it has now rebounded. Show this S&P 500 chart to the annoying cousin who seems to be an expert on the market.

S&P 500 Index Performance Nov. 2013 to Nov. 2023

The Boomers, meanwhile, will be focused on Social Security and its overall health. They’re concerned about whether their payments will continue at current levels, with Congress doing nothing so far to address the program’s long-term health. (See my article How to Fix Social Security and What to Do While We Wait, in which I propose a way to help with the benefits shortfall possibility.)

Everyone is older and has new financial issues

The oldest granddaughter is no longer a tween who loves that you come to her soccer games. She’s starting college in two years!

The son and daughter-in-law are looking to move to a lower-cost market to save on housing expenses. In fact, the grandparents are thinking about selling their house, too, and downsizing.

So, the kids have questions:

- Can you guys fund the 529 plan at a higher pace to help with college costs?

- Can you help with bridge financing of our house if we want to sell first?

- By the way, what are you going to do with the cash you pull out of the sale of your house?

The advice I give to the Boomers is: Before answering those questions, have your own plan for retirement in place.

Some good news about new planning

Don’t be surprised if artificial intelligence becomes a hot topic as the gravy is passed around. I fall between the doomsayers and the true devotees (see my article Can AI Plan Your Retirement Better Than I Can?). I argue that planning has improved not because of AI, but because some of the typical rules of thumb didn’t hold up during the down years of the pandemic — the 4% rule for starting income, the “100 minus your age” rule for stock investments, etc.

Also, more experts came to understand what I’ve been saying for 40 years, that annuity payments can make your retirement better in a host of ways. (Sneak preview: The next major expansion will be to increase your income security by using the equity in the house without selling.)

More talking points, and reasons for improved outlooks, include:

- Interest rates on bonds are higher

- Social Security payments are up

- Grandparents’ ages now mean that it’s cheaper to buy lifetime income through an annuity

- Annuity payments have increased (for more about this, see my article Annuity Payments Are 30% to 60% Higher. Time to Reconsider)

If you would like an annuity quote based on today’s annuity rates, check out the annuity calculator at Go2Income.

The dinner table may be the place to start these important financial and lifestyle changes, but the conversations need to continue afterward to reach the best conclusions. To move past casual conversation and toward action, everyone needs to do a little homework, find an adviser whose practice is aligned with your needs and create a plan that hits as many of your objectives as possible.

We’ll fast-forward this process and reveal the results in an upcoming article.

What makes Jerry thankful

I’m lucky to have our family of three generations gathering for Thanksgiving in California and Connecticut — while I’m the Uncle Jerry at a brother-in-law’s dinner table. We’re healthy and happy (even the teenagers).

And I appreciate the people who read my column. They’re a large group of DIYers who want to take charge of their retirement and make it better. They ask me questions and work out options at Go2Income. Let’s get to work on the best retirement for everyone!