With Go2Income’s Planning, Lower Fees, and Lower Taxes, You Can Get All Three

Our wish is for the New Year to bring less chaos and disruption and more satisfaction, even as we acknowledge that many of those hoped-for gains will require new thinking and energetic approaches.

Come with me as I examine some new thinking when it comes to your retirement finances.

For a long time, it was thought that an encyclopedia could not at once be authoritative, comprehensive and current. At least one of the three important qualities had to give.

Then came the internet, and the trilemma of the encyclopedia disappeared. But philosophers enjoy the concept that only two out of three objectives for a single concept can be attained, and there are trilemmas posed for religious beliefs, politics, economics — and even triathlons.

The common trilemma for retirement income is thus: You can create spendable income, enjoy low risk, or build a legacy for your heirs. Pick two and let the other one go.

I contend that this trilemma, just like the one about the encyclopedia, has outlived its usefulness.

Start with Retirement Income Planning

An Income Allocation plan for retirement offers a trinity of planning features: Your plan will integrate annuity payments into your income stream, lower your fees and taxes, and expose your income to lower risk.

With these three features, you can in fact achieve higher spendable income, decrease your income risk and achieve a higher legacy. (Important note: legacy is defined as the amount available to your heirs, after tax, at your passing later in retirement.)

Here’s how to solve the trilemma:

Higher Income: A mix of guaranteed and other safe income, together with withdrawals subject to reasonable market risk, is the best way to create income during retirement. I suggest annuity payments as a way to provide a high level of guaranteed income that lasts a lifetime. Combine that with dividends, interest and IRA withdrawals, along with Social Security payments and a pension if you are lucky enough to have one. Allocating your income among these major income sources provides a reliable stream of lifetime cash flow substantially higher than withdrawals from traditional asset allocation planning.

Lower Income Risk: When annuity payments, dividends and interest make up a major portion of your income, you will be less dependent on IRA withdrawals, which in turn are dependent on the ups and downs of a portfolio invested in stocks and bonds. (You may also have a buffer portfolio of short-term investments that could be a temporary parking place for these withdrawals.) To further reduce volatility in your Income Allocation Plan, you should make a conservative assumption as to the long-term market returns in setting your Plan income and required withdrawals. If you actively manage your Plan once it is set up, you will be surprised at how small the market impact on your income will be — primarily because so little of the income is dependent on the market.

Maintain a Legacy:In traditional retirement income planning, the advice is often to spend down your savings from a portfolio of stocks and bonds, leaving you with the risk of running out of money. Very few retirees in this current low-interest environment are able to live off interest and dividends and thus leave the full current value of the underlying bonds and stocks as a legacy at their passing. And it may seem counterintuitive that including annuity payments with no underlying account value in a retirement plan can provide your heirs with a significant legacy. But starting with the first two — higher income and lower risk — here’s how you can achieve the trilemma with Income Allocation planning.

Your Income, Risk Reduction, and Fee/Tax Savings Solves the Trilemma

A typical financial planner will help you determine a retirement budget, and then guesstimate how long your savings can pay for that lifestyle. If the calculations show you will run out of money early, their advice will be to lower your budget.

An Income Allocation plan generates income of 30% to 50% more than a traditional plan; however, the legacy under such an income-rich plan is often lower than the legacy of a traditional plan. But you will see here that decisions you make with your higher income can deliver more financial legacy, without increasing your income risk.

Increase Legacy Using a Portion of Higher Income

- Spend on life or long-term care insurance, thus increasing or preserving the legacy.

- Reinvest in tax efficient accounts. In particular, consider products like a Roth IRA or Health Savings Account.

- Make gifts during your lifetime to create a living legacy.

Reduce Taxes During Retirement and at Passing

- Reduce your retirement tax rate from tax-advantaged income in the form of annuity payments and dividends.

- Reduce your legacy tax rate and leave heirs primarily with accounts that receive a step-up in basis at death.

Improve Long-Term Returns Because of Lower Income Risk

- Stay the course without reacting to market ups and downs.

- Increase allocation to high-dividend stocks in a personal savings account.

- Increase allocation to total return stocks in balanced portfolio within a Rollover IRA account.

Lower Fees to Increase Growth of

Financial Legacy

- Reduce investment amounts subject to high advisory fees.

- Use low-cost ETFs and a Direct Indexing portfolio to lower investment fees.

It’s Not Wishful Thinking. Here’s an example.

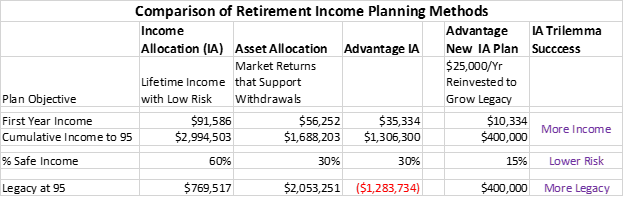

Let me give you a simple example for a female retiree who has $2 million in savings with 50% in an IRA, assuming a long-term return in the market of 6%. Set out below is a comparison of Income Allocation planning to traditional asset allocation planning. After studying the first three columns you may conclude that for income, you should go with the Income Allocation Plan, and if you want to leave a legacy, your only option is to choose the traditional Asset Allocation plan. That’s where you could go wrong.

When our retiree invests $25,000 of her income advantage in a new Income Allocation plan, she still has $10,000 in additional spendable income over Asset Allocation in Year 1. The advantage will continue to grow each year, and she would end up with about $400,000 in more income over her lifetime and leave about $400,000 in more legacy at her passing at age 95. All achieved without taking more risk.

With her new Income Allocation plan, our investor solved the “Trilemma of Retirement.”

Bottom Line

Everyone planning for retirement will rank their financial goals and have slightly different approaches to reach them. An Income Allocation approach works because with more income and lower risk you’re in control of your destiny — at least as measured by your financial legacy.

Sounds like a perfect New Year’s resolution.

Find out more about how to meet all your goals. Visit Go2Income for more information on how Income Allocation can help you balance your retirement priorities or contact me to discuss your situation.