The seeds of IRA4Income were planted when the IRS adopted rules for distributing funds from a rollover IRA. This is incredibly important since the Rollover IRA plus 401(k) and other qualified savings held by retirees represent trillions of dollars in retirement savings

IRS accountants focused on a way for the government to eventually get its tax revenue, while at the same time delivering a reasonable amount of income to the IRA holder. These tax collectors also wanted to create something easy to administer; they weren’t thinking that these IRA funds might be necessary to cover long-term care or other health related costs.

Most of the IRA planning attention since adoption has been on taxes, with the start years for RMDs being pushed back, and rules for converting to a Roth IRA to eliminate taxes at passing.

By working outside that Rollover IRA box, however, Go2Income brings other assets into the equation and actually creates a retirement plan that can protect you for the rest of your life, while in good health and meeting long-term care and health-related expenses. That’s why lifetime income annuities and the value of your home are part of IRA4Income.

Bottom line, don’t favor a particular financial industry. Instead, plan with all retirement asset classes.

Which Asset Classes Does IRA4Income Use?

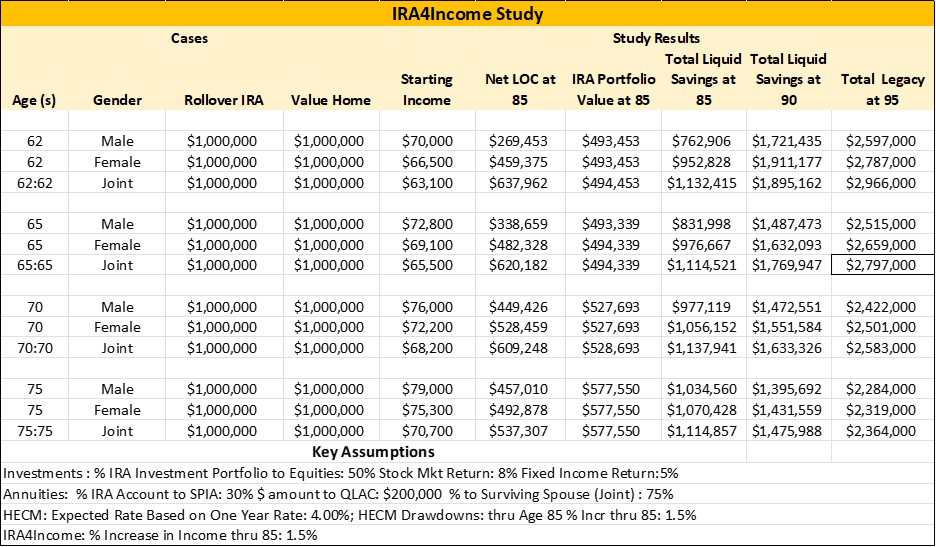

Our new study, described here, shows that you could plan on an increase in starting income of 50% to 75% over traditional investment-only planning by utilizing:

- A balanced investment portfolio invested 50/50 in fixed income and stock investments

- Lifetime income annuities with income starting immediately or in the future

- A home equity conversion mortgage (HECM) that generates income and liquidity

What’s unique is that the asset classes come from three separate financial businesses, i.e., investment, insurance and mortgages, and the Go2Income planning methodology (a little like AI) has figured out how to put the pieces together for maximum benefit – for all retirement ages and objectives.

Besides the huge increase in income, IRA4Income creates more liquid savings than the Rollover IRA alone. By age 90 liquid savings are nearly triple the IRA balanced portfolio. That increase could help to cover, for example, the long-term care costs that 40% of retirees will incur.

How does IRA4Income work?

We’ve put the assets together into IRA4Income by first combining into two programs (a) IRA2Income – made up of investments and immediate annuities, and (b) HomeEquity2Income – made up of HECM and a QLAC deferred income annuity. (These programs can also be set up on their own to provide targeted benefits, even if retirees don’t seek the maximum win-win of complete integration into your retirement income plan.)

Results of the study are provided for different ages, marital status, IRA savings amounts, value of home and market conditions. The old rule was that you could take $40,000 as starting income from your $1 million IRA. Now you can earn starting income amounts that range from $60,000 to $80,000, depending on the case. Set out below is a set of illustrative results with key assumptions listed below.

Note that the liquid savings under IRA4Income are available to meet significant long term-care and related expenses.

How IRA4Income Study Results Depend on Underlying Assumptions

As with any retirement plan, the study results are based on certain assumptions as to the performance of each asset class. In setting up a personalized plan you can customize the assumptions to your risk tolerance. The most important aspect of IRA4Income is that no one assumption drives the results. The lifetime income annuity is fully guaranteed and is issued by a highly rated insurance company. The HECM interest rates are adjustable within limits, but a large portion of the mortgage interest is paid by the QLAC deferred income annuity. And the IRA investment assumptions reflect an equity return that is lower than long-term market returns; and results are less sensitive to swings in equity returns.

Instead of living with their savings in different silos for stocks/bonds, annuities and the home, retirees can now combine all their assets and create a retirement plan for different circumstances before they arise.

Visit Go2Income to order a Go2Income plan that with IRA4Income inside can meet more of your retirement objectives. A Go2Specialist can answer questions about the plan or refer you to a qualified adviser.

About Jerry

Jerry Golden is a nationally recognized advocate for retirees and for those planning their retirement. As an innovator, Jerry has often had to challenge the accepted wisdom of both product providers and distributors, and drive regulatory change where necessary.

His executive experience includes:

- President, Golden Retirement, LLC

- President, Income Management Strategies Division of MassMutual

- Executive Vice President, AXA Equitable

- Founder and President, Golden American Life

- President, Monarch Resources, Inc.

Today Jerry’s innovation continues with Go2Income, where advisors and retirees can explore all types of retirement income options. The result is a personal approach that allows consumers to create dependable, spendable retirement income that will last a lifetime.