Planning for retirement is challenging enough when you have to consider questions like:

- Did I save enough?

- Can I stay in my house?

- Can I afford to take market risk?

- Will I need special care in my old age?

Most investors would not think that they had to worry about their retirement calculators and the plans produced by those calculators. But they might involve the greatest challenge of all.

The planning gap

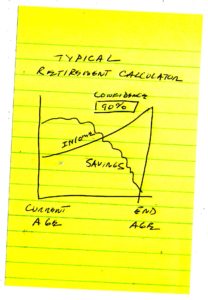

With traditional retirement calculators, you input your current age, your hoped-for retirement age, the amount of money you think you’ll need each year in retirement, as well as the number of years you would like your retirement savings to last.

For those who are 60 now, statistics say you are likely to live to 84 (men) or 86 (women). Of course, half the 60-year-olds alive today will live longer than their early to mid-80s. If you are healthy and an optimist, perhaps you tell the calculator you need the money to last until you are 90. It will give you a lower annual spending limit, and your advisor will provide tips on how to live more frugally.

For those who are 60 now, statistics say you are likely to live to 84 (men) or 86 (women). Of course, half the 60-year-olds alive today will live longer than their early to mid-80s. If you are healthy and an optimist, perhaps you tell the calculator you need the money to last until you are 90. It will give you a lower annual spending limit, and your advisor will provide tips on how to live more frugally.

But the spending and savings numbers are suspect from the start, and likely cannot be reached. That’s because the calculators make predictions — aptly called Monte Carlo simulations — based on historic averages of the stock market and other investments.

Predictions don’t tell you how much money you will have at a certain age. Instead, they give you a range of probabilities. Hitting the average from your investments is as good a bet as predicting exactly how long you will live; the exact average is unattainable.

The calculators also are not built to answer “what if” questions about how your savings might support your family should you die, or what kind of legacy you will be able to leave to the grandkids.

How implementing your plan actually works

From the beginning, the calculator plan produces a gap between the hoped-for objective and the amount of money actually produced. The projection will show your income, taken from savings, increasing with inflation in a steady march throughout your life span.

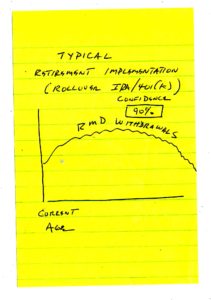

In reality, life gets in the way of the projections. For one thing, yesterday’s markets are rarely predictive of today’s, especially in the short run. When you are ready to cash out your stocks, the market could be down and take months or years to recover. And your confidence level changes as you get closer to, and enter, retirement. You probably won’t be comfortable keeping the same exposure to the stock market throughout your retirement.

In reality, life gets in the way of the projections. For one thing, yesterday’s markets are rarely predictive of today’s, especially in the short run. When you are ready to cash out your stocks, the market could be down and take months or years to recover. And your confidence level changes as you get closer to, and enter, retirement. You probably won’t be comfortable keeping the same exposure to the stock market throughout your retirement.

Also, if you’re adopting a withdrawal strategy, these withdrawals are unlikely to match your projected inflation-protected income. A perfect example of an imperfect implementation plan would be withdrawals from your rollover IRA or 401(k) account. By the time you reach 70½, you must start taking Required Minimum Distributions from those types of savings. While a typical retirement calculator assumes steadily increasing income each year until the savings run out, RMDs will vary each year, based on your investment results, and will increase then fall over your lifetime.

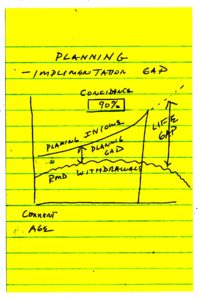

Wide gap between planning and implementation

Unfortunately, you will spend your retirement working to figure out and close the gap between planning and implementation.

To fund your retirement, you need to implement income payments for life, not for a set period of time. In other words, to put your personal retirement in a healthy place, you have to address your risk of running through your savings. Without that, your plan could leave a huge gap that you will spend the rest of your retirement struggling to close.

To fund your retirement, you need to implement income payments for life, not for a set period of time. In other words, to put your personal retirement in a healthy place, you have to address your risk of running through your savings. Without that, your plan could leave a huge gap that you will spend the rest of your retirement struggling to close.

What’s needed

At Go2Income, we’ve been using a system that integrates planning and implementation for our consulting clients. Our goal is to bring that approach to more individuals through our Go2Income website. We’ll start with a planning approach that is easy to use like the retirement calculators, but tailors each plan to your specific, individual situation.

It will give you accurate lifetime income numbers for your retirement and help you decide, with confidence, the methods to achieve those numbers.

Look to this space in July for the announcement. I think you will be intrigued.

I have been creating insurance products and giving retirement guidance for more than 40 years. Visit Go2Income for more information about how to plan your retirement.