Numbers rule our retirement decisions, and we usually have questions about them. At what age will we stop working full time? How long of a retirement should we plan for? What do today’s low interest rates mean to our future income? Can we count on a reasonable dividend yield from our stock portfolio? What percentage of our income should be guaranteed for life, through Social Security, pension income and annuity payments?

Dollars or Percentages

We also look at retirement income as both dollar amounts and percentages. Should we try to replace 100% of our former income during retirement? Or should we set a fixed budget and find a way to meet that amount? You can determine which approach appeals to you by thinking about your last mortgage refinance. Did you congratulate yourself for shaving a percentage point or two off the mortgage rate, or plan for ways to spend the extra $300 you saved every month?

Common Retirement Measure: 4% Rule of Thumb for Starting Income Percentage

The 4% rule of thumb is another percentage, and it looms over the majority of retirement decisions. This is the rule that says people with a reasonable amount of savings when they retire should be able to make that pot of money last for 30 years even as they remove 4% of the total each year for living expenses. Studies have shown that three-quarters of all financial advisers rely on the 4% rule when offering guidance to their clients.

There’s just one problem. Baby Boomers retired last year at the rate of about 8,800 a day, or 3.2 million a year. And one size does not fit 3.2 million people. In fact, it is reasonable to think that every one of those retirees will seek a number that is right for them as they customize their retirement income plan to their specific needs. Further, the number is dependent on market conditions. When Wade Pfau, a financial academic, was asked whether the 4% rule of thumb still applies, he suggested that while it worked historically, it never dealt with the current low interest rates and high stock market valuations at the same time.

Your Starting Income Percentage is Unique to You

No ordinary rule based on averages can replace the factors you need to consider when figuring out how much income your savings can generate. Those factors include:

- Your age, gender and marital status, all of which impact the life expectancy of your plan.

- Market returns, interest and dividend rates, and inflation expectations.

- Your legacy objectives for your kids and grandkids.

- The amount of retirement savings you have accumulated.

- Where your savings are invested: rollover IRA versus personal (after-tax) savings or even equity in your home.

- Your attitude toward taxes, both current and proposed.

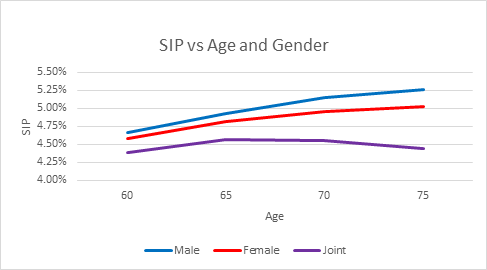

To illustrate, the chart below shows the impact of just three variables — age, gender and marital status — on what a viable starting income percentage could be for you using the Income Allocation planning method and typical savings makeup and legacy objectives.

Starting Income Percentage as a Function of Age and Gender

You can see that, unlike the general 4% rule of thumb, a recommended SIP can vary from a high of 5.26% to a low of 4.39%, even before we take other factors into account. Our point is not that it’s higher than the 4% rule, it’s that it’s personalized to the individual. Further, even though it’s more customized, you need to drill down and find out what’s behind the Income Allocation numbers.

What’s Behind the SIP

Analyzing the SIP and getting the most out of it can make a significant difference in your retirement. For example, if a plan customized for you delivers just 1% more in income per year from your $1 million in savings, that’s $10,000 more to spend in your first year of retirement, or — with 2% annual increase — an additional $337,000 over 25 years.

And it’s not enough to select a plan based on whether the number is higher or lower. What you need is a plan that provides you information as an informed investor:

- What is my projected income, and what are the sources of that income?

- What percentage of my income is safe and not dependent on market returns?

- What are my projected savings, how much liquidity do I have, and what’s the legacy?

- What are the economic assumptions underlying these projections?

Don’t be put off by the technical-sounding nature of these questions. It’s important that you get a report on your plan, review it yourself or review it with an adviser. That review can give you confidence — or not — in your number.

Do want to get your number?

Using our Go2Income Guide you can answer a few questions and get your Starting Income Percentage. You can do it on your own and get an instant idea of what an SIP specific to you might be. You can then order a full report with projected income and savings. Then, if you wish, you can connect to an adviser.