To paraphrase Marty McFly, who time-traveled between the 1950s and the 21st century in a souped-up Delorean sports car, the key to a successful retirement is to plan “back from the future.”

Actually, Marty didn’t concern himself with retirement. But imagine how the rest of us could improve our retirement planning if we had a glimpse of what will really happen 20 or 30 years from now. We would know exactly how to invest our savings, what the cost of living or market returns will be, and what happens to our health, our kids and grandkids.

Alas, to quote another great mind, physicist and philosopher Niels Bohr, who won a Nobel Prize, “Forecasting is particularly difficult, especially concerning the future.”

That leaves us only with planning from the present.

That leaves us only with planning from the present.

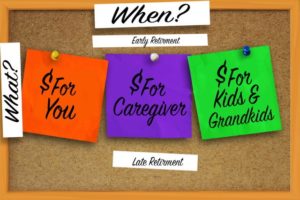

Even as we all hope to live long and healthy lives, you’ll be a better planner if you anticipate what might go wrong in retirement. I said in the first part of this blog that I would tell you how and when to plan for the basic retirement objectives that will bring a bright retirement future. I call them the Three Ls: lifetime income, liquidity and legacy.

Stage I of retirement and Stage II

We buy life insurance just in case we die young. The insurance provides income for our loved ones and also might have a specific focus, like paying off a mortgage. These are the concerns that often occupy us as we prepare for Stage I of retirement.

We can also now buy income insurance to meet our income needs in Stage II of retirement, when, beyond basic living expenses, we might need to cover the expense of unreimbursed medical costs, home health care, or life or long-term care premiums. By meeting those “extra” expenses, you are preserving your legacy and providing peace of mind.

And if nothing goes wrong – you stay healthy throughout your life and don’t need extra care – your income insurance can become gifts to your kids or grandkids or your alma mater, or they can be reinvested back into savings, thus building your estate.

What is income insurance?

Another name for income insurance is an income annuity, and there are two forms that provide income in Stage II of retirement.

One is called “QLAC” and can be purchased from a 401(k) or rollover IRA, with payments usually starting at age 80 or 85. You can spend up to $125,000 of your retirement account or no more than 25%, which will provide tens of thousands of dollars each year when you reach the payout age.

The other form of income insurance comes from a deferred income annuity, which can be purchased from other types of savings but offers similar benefits.

In each case, the income annuity will provide income for the rest of your life. You won’t have to worry about running out of money, being forced from your home, or paying down your assets to qualify for Medicaid.

Deciding whether income insurance is right for you

Making this decision is not easy, but we can borrow an insight from the book mentioned in Part I of this blog, “The Undoing Project,” by Michael Lewis.

That is, people often make decisions to minimize regret rather than maximize happiness.

Let’s see how that relates to the decision to buy income insurance.

Assume because of your family history or current health that you can expect an average or longer lifespan. What would be your greater regret?

- Spending money on income insurance now and leaving a little less to your kids if you pass away in Stage 1, or

- Running out of money in Stage 2 and relying on your kids for support?

If you’re more concerned about number 2, then you should consider income insurance.

I have been studying retirement risks for more than four decades. While everyone’s situation is different and their solutions vary, I have found that most people haven’t thought enough about creating guaranteed lifetime income. But I do know (and academic research confirms) that you will feel much more content if you have enough income to pay your bills throughout your life.

My website, Go2Income, lets you design income annuities that fit your personal circumstances. You will be able to create “what if” scenarios on your own to figure out how much income your savings will buy, and then compare that to other options in the marketplace.