I read two books over the holidays that, while written for a general audience, can provide crucial insights into retirement planning. The first was a biography of two brilliant psychologists called “The Undoing Project,” by Michael Lewis. The second was “Time Travel: A History,” by James Gleick.

How are books about psychologists (Kahneman and Twersky) and time travel related to retirement plans?

My own insight is that a successful retirement is mostly about making decisions in the present – a lot of them financial – combined with a vision of how you want your future to look. If people understood how the decisions they made today influence their future, they would create a more secure and financially rewarding retirement for themselves and their families.

Lewis’ book suggested that people often make less-than-rational decisions, especially when comparing alternative choices. And when it comes to money, it’s even more challenging.

How People Make Decisions

An example from the Lewis book suggests how people faced with three options, A, B and C, often give somewhat illogical answers.

In making the decision, people often look at choices two-by-two, comparing A to B, B to C and A to C. While the individual might prefer A over B, and B over C, in some number of the cases they actually would prefer C over A. They don’t realize their preference, though, because they haven’t taken that extra step to compare.

Here’s how the decision-making might apply his decision-making concept to retirement planning with three basic choices: (A) Guaranteed Income for you and spouse, (B) Liquidity for Unplanned Expenses, and (C) Legacy for your Children.

Now take them two at a time:

- (A) Guaranteed Income vs (B) Liquidity

- (B) Liquidity vs (C) Legacy

- (A) Guaranteed Income vs (C) Legacy

Did that help or hurt the decision-making process?

The ability to balance each desired result against the others certainly raises options and considerations that might have been otherwise lost.

What if you didn’t have to choose, and could have all three?

How timing fits into planning

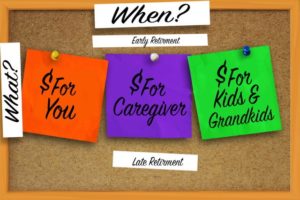

Gleick, in reporting on the notion of time travel, suggested to me that an important factor in our ultimate decision-making is often not the “what” but the “when.” Therefore, if you think through the timing of A, B and C, you might be able to meet all three objectives.

Gleick, in reporting on the notion of time travel, suggested to me that an important factor in our ultimate decision-making is often not the “what” but the “when.” Therefore, if you think through the timing of A, B and C, you might be able to meet all three objectives.

If you think through your objectives – guaranteed income, liquidity, and legacy – and also keep the life stages of early and late retirement in mind, it may make your decision process a lot easier. Here are a few questions to ask yourself.

When it comes to income, how important is it that the income be fully guaranteed early or late in retirement?

Is it more important to have liquidity for unplanned expenses early or late in retirement?

Finally, as regards any legacy, what’s more important – early or late?

Get time on your side

While individuals will make their own decisions, my guess is that the scales favor getting the highest results late in retirement. That’s a good thing, because you have time on your side. That’s also a challenging thing since without a time machine, how do you make decisions in the present that produce your desired results in the future.

I will offer my guide on how to effectively peer into the future as you make important retirement decisions in Part II of this blog.

If you can’t wait to ask Jerry a question about your retirement decisions, write to him here. He will answer you personally.