In my articles about how to build a better retirement plan, I often point out that homeowners who include home equity as an asset in their retirement plan can meet more of their retirement objectives.

The number of retirees who take advantage of a Home Equity Conversion Mortgage or HECM, however, has never equaled retirement experts’ expectations. It’s not the design or pricing of the product, but rather, in my view, the limitations on how performance of HECM is presented, and the challenges of integrating HECM as part of a broader retirement plan.

This article and the next discuss how we address these two issues. The answer is not radical. Treat HECM as an important asset class in an overall retirement solution while complying with applicable regulatory rules.

HECM analysis is similar to that applied to other retirement assets

Here’s what we have to answer for any asset, with additional questions when using HECM:

- How does the value of the asset fluctuate with the market? For HECM, how does market price of your house increase or decrease?

- How does the asset deliver cash flow and how is it taxed? For HECM, what are the interest costs in borrowing that necessary cash flow and how is that cash flow taxed?

- How do the liquid savings grow or fall to meet unplanned expenses? For HECM, how does the available line of credit change over time?

- How much does the asset leave as a legacy in different market scenarios? For HECM, what is the net equity in your house after paying off the mortgage at your passing?

The HECM analysis is similar to those for an investment asset class, with the key difference being that you’re borrowing and incurring interest while still maintaining the asset, rather than withdrawing and giving up the potential returns on the investment. The amount borrowed is not taxable, and interest paid is tax deductible. In addition, HECM interest rates are adjustable based on a formula unfamiliar to most homeowners. This is new territory for homeowners and, often, their advisers.

Consider housing price volatility while assessing this asset

To state the obvious, housing prices can vary from year to year, although over the past several generations they have trended up. There are also regional differences to take into consideration. The region that includes Illinois, Indiana, Michigan, Ohio, and Wisconsin, for instance, along with the region of Alabama, Mississippi, Kentucky, and Tennessee, both experienced lower pricing growth than the rest of the country from 1995 to 2025.

The broad message for planning is not to try to predict the exact amount of savings or legacy for each homeowner but to demonstrate the possible impact of the price ups-and-downs on your own plan. At certain moments during retirement, the price of your house could affect how you use HECM.

While most investors have a general sense of the volatility of returns of the stock market, they are less aware of changes in housing prices unless they’re looking to sell their house. In our retirement planning, we include the value of the house particularly because of its impact on the legacy one will pass on.

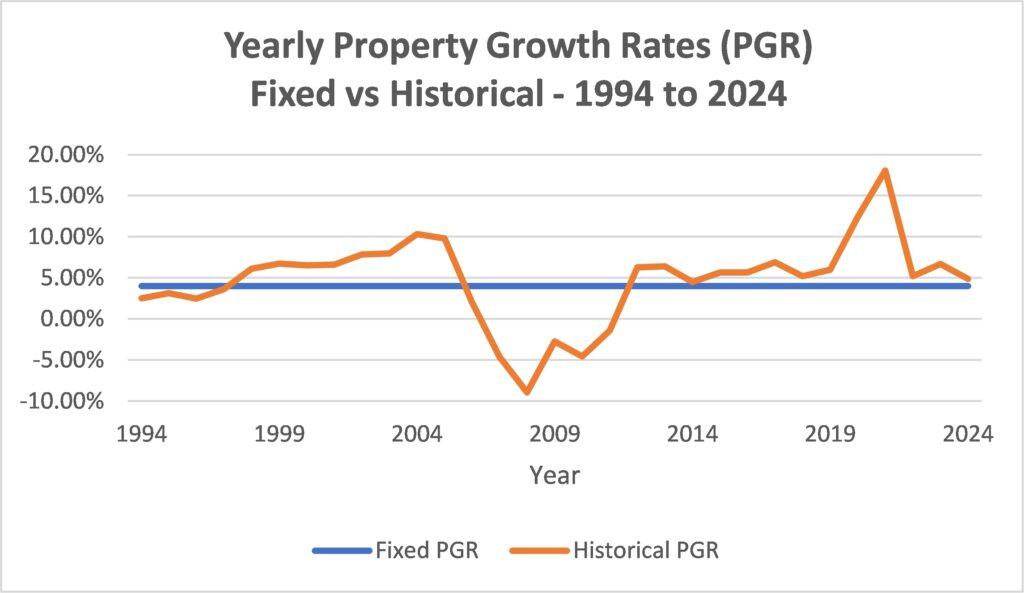

Set out below is the historical performance of U.S. housing prices over the last 30 years. Included for comparison is the 4.0% return commonly used in HECM illustrations and the compound rate of return of 4.7% that actually occurred over this period.

Even during the period surrounding the 2008 financial crisis indicated in this graph, a homeowner’s line of credit grew rather than fell. That feature is enabled by HECM terms and HUD’s insurance guarantee (see below).

The essential take-away is that you’ll want to stress-test this asset just like you would your investment accounts. The tests will show what happens when the housing market dips, and how your finances might look over a longer period of time.

HUD insurance reduces market risk for beneficiary

The U.S. Department of Housing and Urban Development (HUD) backs every HECM loan, insuring that the borrower’s family will not owe money at the passing of the borrower or eligible surviving spouse, even if the outstanding loan balance is more than the value of the house. HUD insurance covers any difference for the lender.

The family can either sell the home and repay the loan, keeping any excess equity, or pay off the lesser of the loan balance or 95% of the home’s appraised value to keep the home. The insurance also provides for borrowers to continue receiving scheduled loan advances or line-of-credit access even if the lender goes out of business.

This can be valuable protection in adverse housing markets.

Now consider HECM interest rates

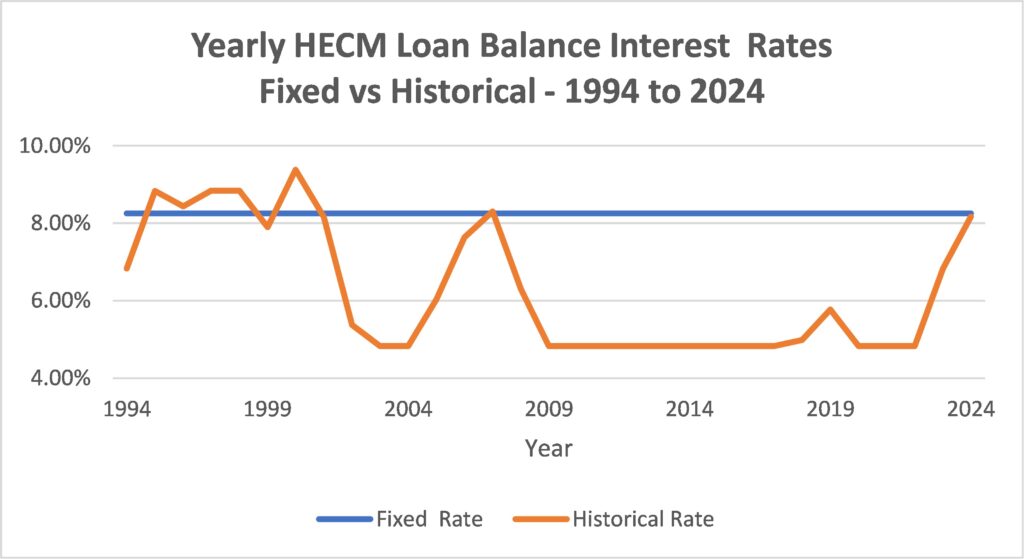

HUD requires that lenders illustrate HECM mortgage interest rates assuming a constant interest rate based on conditions when the HECM is set up, even though most HECM loans are adjustable and interest rates change either annually or monthly.

A study we did determined the adjustable rate, with annual adjustments, for a HECM taken out at the start of a 30-year period in 1994. A summary is presented below.

Note that the adjustable rate for HECM taken out 30 years ago has been generally lower than the fixed rate illustrated for that same mortgage. That has a couple of effects. While a lower rate does produce a smaller loan balance, it also lowers the amount of the line of credit over time. Most importantly, the adjustable rates are a better indicator of how your results will emerge, reflecting both fluctuating interest rates and the cap and floor in the HECM design.

The impact of historical rates on HECM results

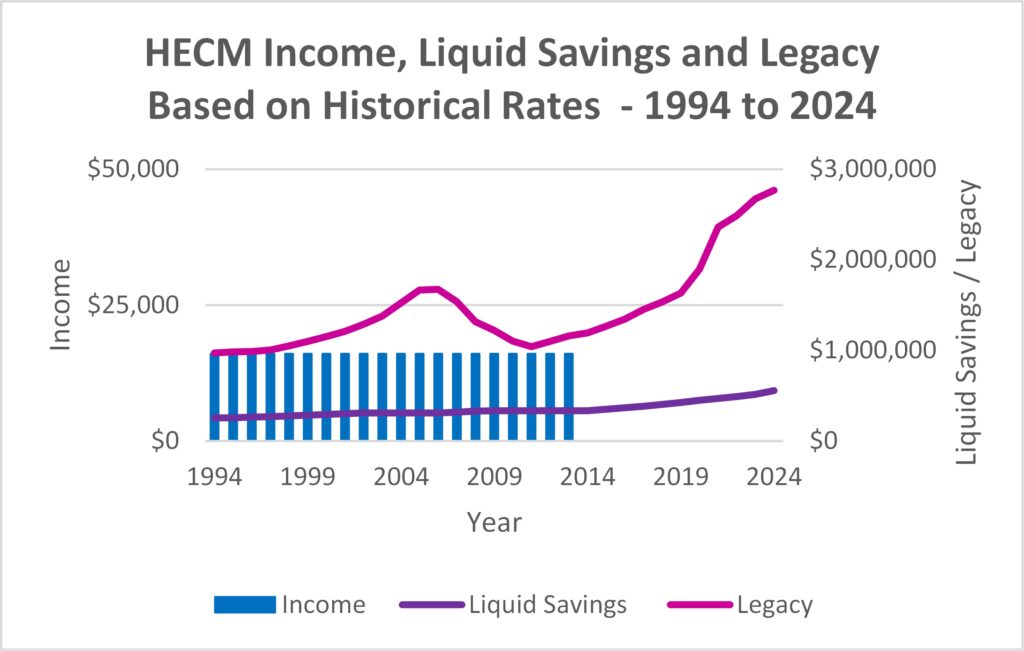

With the above background on historical housing prices and adjustable rates, the next step is to measure the overall impact on HECM results. While there are virtually unlimited patterns of loans, we took an example for a male, age 65, with a home worth $1 million and no mortgage, whose goals were to supplement income until age 85, create stable and growing liquid savings for long-term care and unplanned expenses, and leave a substantial legacy.

As seen in the chart below, even in this volatile period our homeowner was able to meet his objectives for income, liquid savings, and legacy.

While similar to the housing market generally, the plan reflects the decline in prices post-financial crisis while still delivering the homeowner with income and liquid savings to supplement his retirement plan, and still preserve a substantial legacy. And maybe most of all, even with volatile interest and housing prices, enabling the homeowner to age in place.

Benefits of combining HECM with QLAC

In earlier blogs we’ve talked about combining HECM with QLAC. (See my blog on What the HECM?) QLAC is a Qualified Longevity Annuity Contract that provides guaranteed lifetime income with flexibility to select the date annuity payments begin, along with tax savings associated with the ability to defer some Required Minimum Distributions. This QLAC calculator can help you figure out how it might work for you.

Most of the analysis of the benefits of QLAC on a HECM have been based on fixed property growth and fixed HECM interest rates. But as discussed above, historical rates show a different picture.

In our next blog we will show how the addition of QLAC in prior periods would have not only addressed longevity risk, but also reduced risks from fluctuations in housing prices and HECM interest rates.

For your next step request an illustration at Go2Income. A HECM specialist can answer your questions and help you better understand HECM.