As you know, things sometimes don’t work out the way you plan. People die too young or need professional care after an illness or disability. Sometimes, just living to a nice old age drains the savings you worked so hard to bank.

That’s why people who care about their families and themselves buy insurance to address these life risks. And believe it or not, the government occasionally recognizes – and rewards – those of us who plan ahead for the unexpected. Life insurance is one example: Payouts to beneficiaries are received income tax-free.

Longevity insurance – in the form of income annuities — also receives some tax benefits. (Those benefits could and should be better, however, as we will discuss in Part 2, publishing soon.)

Longevity insurance – in the form of income annuities — also receives some tax benefits. (Those benefits could and should be better, however, as we will discuss in Part 2, publishing soon.)

Retirees and near-retirees face two important tax impacts when they consider including income annuities in their retirement portfolio: First, which of their savings sources will they use to buy the annuity, and second, once they begin to receive payments from the annuity, how will they be taxed?

Savings sources

Individual investors typically find money to fund the premiums for income annuities from one or more of the following three savings sources. Each has a different tax treatment:

- If you already own a deferred or accumulation annuity, which helps you accumulate savings on a tax-deferred basis, you can exchange that annuity without tax for an income annuity, providing income starting now or in the future. This so-called 1035 exchange rule allows you to shop for the most attractive rates for the income annuity, without staying with the company that issued the deferred annuity. That tax-free exchange means that while the deferred annuity’s cash value may be higher than the original premium (“cost basis”) paid, there is no tax on the gain when exchanged under this rule. Rather, any tax is spread out when annuity payments are received. Such treatment is more favorable than when withdrawals (fully taxable and penalized before age 60) are taken from the deferred annuity.

- If you hold a rollover IRA or have savings in a 401(k), you can roll it over to an income annuity tax-free. Because the money in your IRA or 401(k) has not been taxed yet, eventually you will pay taxes on the monthly or annual annuity payments you collect. In a rollover IRA or 401(k) your cost basis usually is zero. But if you roll out to a deferred income annuity called a QLAC (with a maximum of 25% of your account value), you can put off those annuity payments up to age 85. That will further delay your tax payments. There are significant benefits from, say, 15 or more years of deferral: (1) tax-deferred compounding increases QLAC payments; (2) lower tax rate in the second stage of retirement; and (3) offset annuity payments with deductible expenses for unreimbursed medical and caregiver expenses.

- Personal savings, on the other hand, do not benefit from a tax-free exchange or rollover. You might have to sell bonds, mutual funds or stocks and recognize a capital gain to pay the annuity premium and pay tax (at lower rates) on that capital gain. However, since you’ve paid the taxes on the sources of this premium, you establish a cost basis, and once you start receiving payments from your annuity, your cost basis won’t be taxable a second time.

Deciding where to fund your income annuity premium can be tricky, but here are a few rules we follow:

- Develop an overall retirement income plan to decide how much of your income should be in the form of annuity payments.

- Look at each savings source and examine the relative tax and risk management advantages in income annuities vs. alternative investment strategies.

- Allocate between immediate and deferred income annuities to both manage income and minimize tax, e.g., purchase a QLAC whenever possible.

Understanding annuity payments

When you receive an annuity payment from the insurance company, whether monthly or annually, the overall amount is not broken down into its component parts for you to see. That is unlike, say, a mortgage payment, which is split between repayment of principal and interest. From a financial standpoint, however, the annuity payment comes from three different elements:

- Return of pro-rata part of your premium.

- Interest earnings from the insurance company.

- Longevity credit* or risk-sharing benefit from the insurance company.

Regarding the last component, if you live a long time, you can earn much more than you put in through these longevity credits, making it a favorable financial arrangement for you.

Keep those three components in mind when reading about how annuity payments are taxed now (below) and how they should be taxed, in my opinion (Part 2).

How Annuity Payments are Taxed Now

As indicated above, if the money you spent to buy an annuity was already taxed (meaning you used money from your personal savings or an existing deferred annuity), the IRS lets you exclude that portion from additional tax.

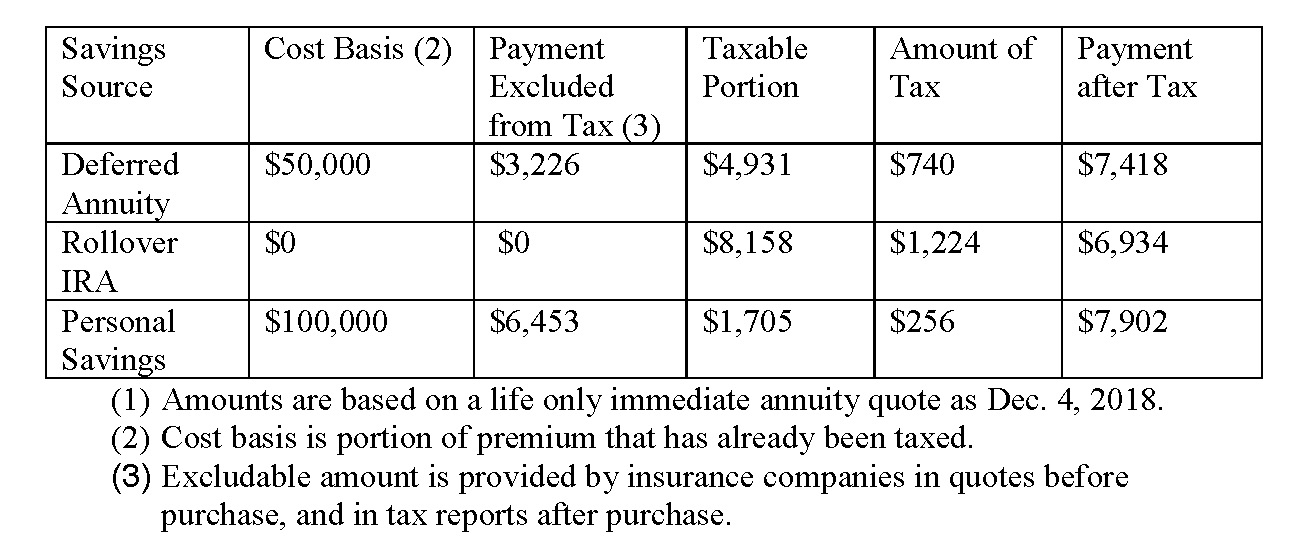

The chart below shows the tax calculations (15% tax bracket) for an income annuity providing $8,158 (see note 1 below) of annual income for a male age 70 with a $100,000 premium paid from different savings sources.

The amount of annuity payment excluded from taxes is limited to the cost basis, and anything beyond that amount is fully taxable. The tax break from excluding the cost basis on an annual basis is relatively modest in relation to the benefit that society derives from individuals buying their own longevity insurance.

While the tax code treats income annuities fairly with some modest tax benefits, the first priority is using the product to secure the income you need.

The next article will propose changes in the tax code that would provide major benefits to both buyers of these income annuities as well as to the federal government.

*Under an income annuity issued by an insurance company your longevity risk is pooled with other annuitants. Using mortality tables that project longevity, insurance companies pass on their savings when annuitants pass away and their obligation stops. That’s longevity credit from the company’s perspective.

From the buyer’s perspective, longevity credit is the opposite of term insurance. Rather than paying a premium for term insurance, the annuitant is selling a part of his legacy to the insurance company and receiving the longevity credit in return.

Visit Go2Income if you want more information about how annuities can help you increase your retirement income. Feel free to contact me at Ask Jerry with questions.