A reporter called me to ask whether investing in a QLAC would reduce a retiree’s RMDs and the tax that must be paid on them.

The short answer is Yes.

The complete answer is, think about the QLAC decision as part of a broader consideration of your retirement finances. Properly combined with your IRA investments, it can provide steady, lifetime income and may help you to fund a legacy to your heirs.

Let’s examine how you might create a retirement income plan that balances various investment opportunities.

Here is a case study

We’ll start by looking at a retiree with $1 million in retirement savings. She is 70 and 100% of her savings are in a rollover IRA. Her family history indicates she has a good chance of living into her 90s. She is interested in investing some of her IRA account in a QLAC that would start paying her income when she reaches 85 – primarily in order to reduce taxable RMDs.

She may also be interested in an immediate income annuity that would provide annuity payments now to provide a secure source of income in these volatile markets. She is single and her children are self-supporting, so she is considering a life-only annuity for maximum income.

Our investor can shop the QLAC and immediate annuity market for the best rates for each purchase. Different companies will offer better rates at varying ages. Or she can use this opportunity to create a retirement income plan for herself.

She is a good example for our blog because she faces an impending decision regarding RMDs; however, the planning exercise and the conclusions will be generally consistent for you and your situation. We will use graphics to show our retiree’s results in various financial circumstances.

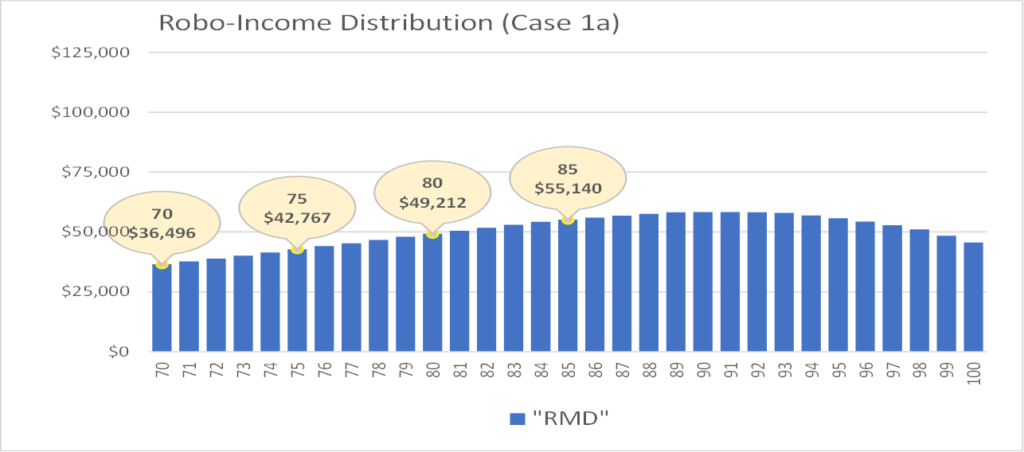

What happens when you rely on investments alone?

The graphic below shows what our retiree’s income would look like if she relies solely on investments in her IRA, including stocks and bonds, based on an average annual return after fees of 4% in the stock market. That rate would rank among the 10% worst prolonged markets. A market return closer to the long-term average of 8% would increase her income, but the downward income curve would stay the same as she ages.

Note that her RMD in the first year is over $36,000.

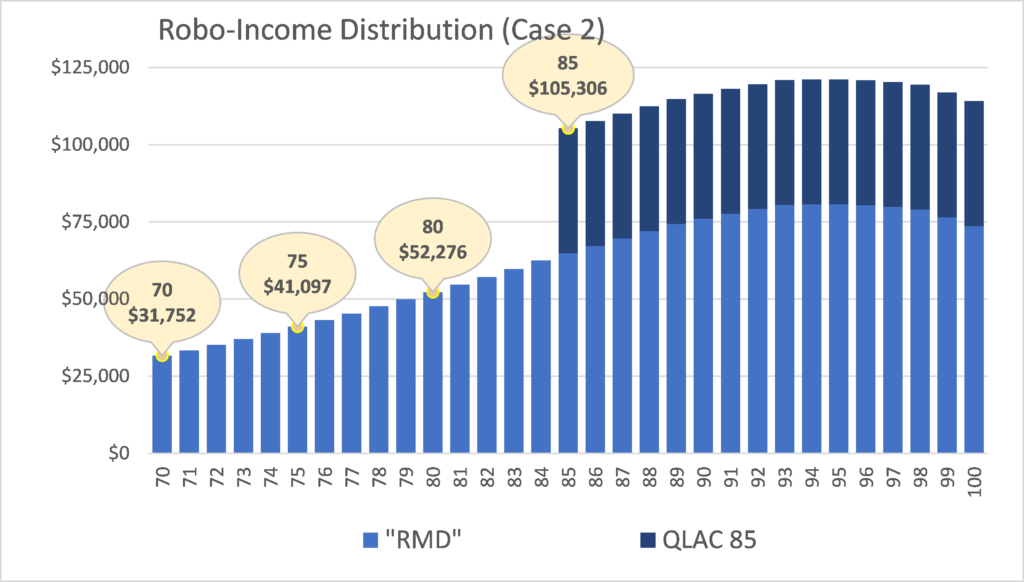

Investment plus QLAC at 85

This graphic demonstrates the answer to the reporter’s question. Our 70-year-old retiree can take up to $130,000 of her IRA and buy a QLAC that begins to pay out at age 85. Not only will the payments help her cover medical and other costs that may be higher at that age, but the RMDs related to the $130,000 purchase price will lower the amount of her RMDs and the taxes she must pay on them from 70 until she reaches 85. Note that her RMD is reduced by nearly $5,000 to $31,700 in the first year.

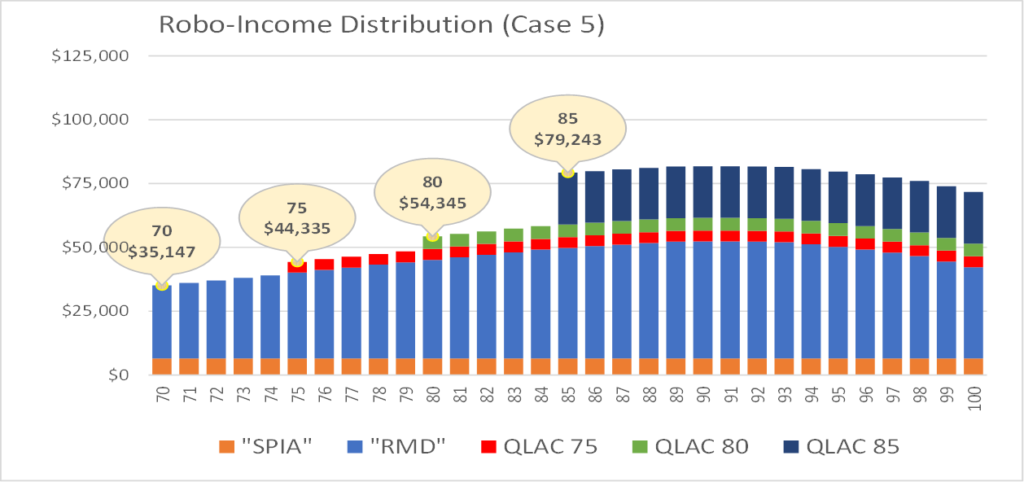

But our investor can also design alternative plans with more logical income

When she adds an income annuity that begins payments immediately, she will obtain an additional source of guaranteed income today – and still maintain lower taxable income than the investment-only plan. ($35,100 vs $36,500)

The following graphic also demonstrates how to “ladder” QLAC investments, an approach that provides increasing income starting in stages at 75, 80 and 85. Again, we show the results with a 4% annual rate of return for stock market investments.

As you see, even with a poor market, a combination of immediate income annuities and laddered QLAC provides much more income – and peace of mind – than a retirement plan invested solely in stocks and bonds.

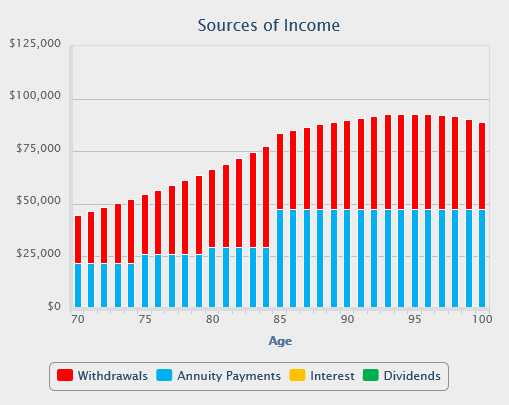

Income Allocation and managed withdrawals from a traditional IRA

Income Allocation from Go2Income is a retirement planning method that emphasizes creating income to last for the rest of your life, no matter how long you live. The income under an Income Allocation plan increases on a regular basis until age 85. Go2Income uses the same components as the DIY plan above but manages the withdrawals, rather than setting them at the RMD level.

Excerpt from Income Allocation Report

While this plan generates more taxable income than the investment only strategy, if your objective is to minimize taxable income in early years and provide a higher level of annual increases in income, then Go2Income can design a plan to accomplish it.

As you will see when you begin to create your own retirement income plan, a focus on only a single aspect – RMDs or overall taxes – is fine as a starting point. But the best approach is to consider all the financial issues you may face over the 30 years of your potential retirement and create a plan that produces the optimal results for your specific situation.

There is no right or wrong answer. However, planning helps you think of all the possible considerations.

Visit Go2Income and plug in your own numbers on the Income Allocation page. If you like what you see, you can talk — with no commitment — to a Go2 specialist who will help you determine all the ways you can improve your retirement.