Don’t bet your retirement on Monte Carlo models

When you sit down with a traditional financial advisor to plan your retirement you will provide her with the spending budget you have in mind. The advisor will adjust that amount for inflation and after running through a “black box” model, will predict how many years your retirement savings – typically made up of cash, stocks and bonds — will last.

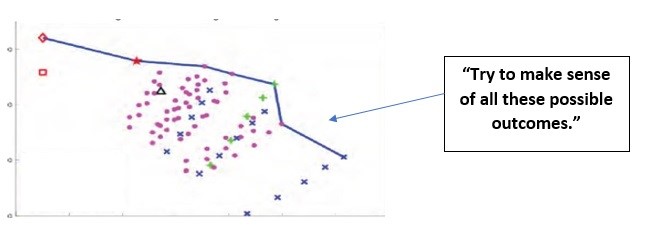

The model to make this prediction is called “stochastic” — a fancy way to describe what is a typical Monte Carlo simulation model.

More