How much of my retirement income should be guaranteed for life?

Knowing the answer could reduce stress during retirement

Buying guaranteed income is in many ways like buying a car. You know you’ll enjoy owning it but the challenge of deciding which model and where to buy it may be unnerving. Just as you need a car for transportation, you need guaranteed retirement income for peace of mind. And similar to purchasing a car, you’ll need to make decisions about your guaranteed income.

- How much do you want to spend? (% of savings allocated to purchase)

- What model do you want? (current or future income)

- What make? (annuity company)

- Which options? (survivor benefits)

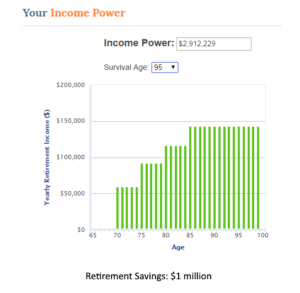

We built Go2Income to help investors answer those questions, for one simple reason. Many studies suggest that retirees appreciate the benefits of having guaranteed lifetime income, whether it comes from Social Security, a pension or income annuities. While the first two are automatic – with limited investor choices – the last is voluntary and very much underrepresented as a percentage of retiree savings. More

We built Go2Income to help investors answer those questions, for one simple reason. Many studies suggest that retirees appreciate the benefits of having guaranteed lifetime income, whether it comes from Social Security, a pension or income annuities. While the first two are automatic – with limited investor choices – the last is voluntary and very much underrepresented as a percentage of retiree savings. More