Get the retirement you want by securing the income you need

Let’s start the New Year with breaking news: Just-enacted legislation called SECURE 2.0 Act of 2022 contains provisions that make it much easier to purchase pension-like income in your Plan for Retirement Income (Plan). The new legislation allows you to defer more taxes and buy more retirement income from your 401(k), Rollover IRA, or similar tax-qualified accounts.

Combine this with the higher annuity payouts due to higher interest rates from these vehicles, and we’re talking about 100% to 250% more income from this source when compared to December 2021. The vehicle is a Qualifying Longevity Annuity Contract — or QLAC for short. Importantly it’s only offered by some of the highest-rated insurance companies in the U.S.

Spoiler Alert: The maximum QLAC per individual is now $200,000 with no percentage limit.

How does QLAC work?

QLAC is technically a deferred income annuity purchased by a tax-free transfer of a portion of your tax-qualified accounts generally made after age 55. That transfer, in addition to adding a QLAC to your plan, represents a reduction in your account for the purposes of determining taxable Required Minimum Distributions. So, if you used 25% of a $400,000 qualified account, your $100,000 purchase of QLAC would reduce your RMDs by 25%. And the income from QLAC could be deferred until as late as your age 85.

While tax deferral to age 85 is nice and has a real economic value, it is also important to think about how you can use the income benefits of that $100,000 investment to improve your retirement. Let me give you two examples:

- A couple, both aged 65 with a Plan that’s in good shape, wants to ensure they can pay premiums on their long-term care and life insurance late in retirement. They can use the $100,000 to purchase lifetime income starting at age 85 of $36,000 per year — guaranteed. More than enough to pay the premiums.

- If you’re single but your Plan is a little shaky after the financial upsets of 2022, and you’re concerned about inflation, you can use the QLAC to ladder guaranteed income that starts at age 75 and continues to grow. More about that in the example below.

Background on Legislation

Most of the news reporting about SECURE 2.0 has focused on the other parts of the legislation that make it easier for part-time employees and employers to create savings plans, along with an extension to age 73 at which age RMDs must be claimed. It also permits unused 529 accounts to be applied to a Roth account. Here is a summary of all the changes from the American Society of Pension Professionals & Actuaries.

At the same time, many retirement advisers have been caught unaware of the QLAC provisions. (I’m being generous. Your adviser may not talk about QLAC or income annuities generally because they don’t have the planning software to provide guidance to customers.)

Rules in the 2019 legislation that created the original SECURE ACT (stands for Setting Every Community Up for Retirement Enhancement), limited the tax-deferred investments into a QLAC to $125,000 (indexed to inflation), or 25% of the account if lower. As mentioned above, the new rules allow up to $200,000 of tax-benefitted savings toward a QLAC and the percentage-of-savings requirement has been removed.

Another benefit is included in SECURE Act 2.0: You can now include a “return of premium” feature in your QLAC so that the purchase amount, less any payouts, goes to a beneficiary at your passing.

What the Higher QLAC Limits Could Mean to You

QLAC investors at the legislative maximum get two simultaneous tax benefits: $200,000 is excluded from the RMD test, and the QLAC income can be deferred to later in retirement. Together with income from the balance of qualified savings and Social Security, the retiree can more easily meet income needs for life, while creating liquidity for other needs late in retirement.

To demonstrate, if in December of 2021 a male age 70, used the maximum $135,000 (the 2021 maximum) to purchase a QLAC, it would have paid lifetime income of $31,000 per year stating at age 85. Now, just a little more than a year later in January 2023, he could purchase income from the same carrier of $75,000 a year. That’s because of the increase in the QLAC maximum to $200,000 a year combined with the higher interest-rate-based payout. (We can help you find your payout, too. Click here if you’d like to get a personalized quote that shows how a QLAC could work for you.)

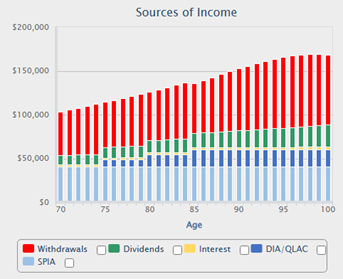

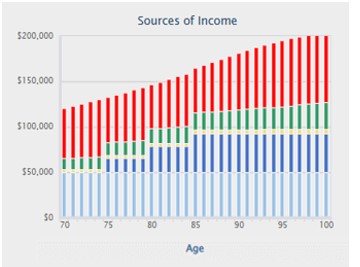

For that same male age 70, the examples below shows similar improvement with a Go2Income Plan for Retirement Income that utilizes dividends, interest payments, IRA withdrawals and annuity payments. (Visit For Sustainable Retirement Income, You Need These 5 Building Blocks for more information.)

- Income results for a plan prepared December 2021:

Starting Income $103,000; Cumulative Income to age 95: $3,459,000

Note: 53% of the income through 95 is considered safe.

- Income Results for a Plan prepared in January 2023

Starting Income $120,000; Cumulative Income to age 95: $4,067,000

Note: 63% of the income through 95 is considered safe.

The higher QLAC limits contribute significantly to this Plan’s “more income-less risk.”

Another View of QLAC

Mark Iwry is a former Treasury Department official who helped create QLAC during the Obama administration and he also consulted on the expansion of QLAC provisions in SECURE 2.0. He told the Retirement Income Journal that QLACs can especially benefit women, who are the most likely to live into their 90s.

“The combination of mortality pooling and predictable investment for 15 to 20 years produces a meaningful add-on to Social Security income starting at 80 or 85,” Iwry told the online journal. “Never mind that Homer [Simpson] thinks all those beers and cheeseburgers mean he’ll never live past 80. The QLAC is for Marge.”

Whether you’re male, female or a couple, QLAC is a financial instrument that should be considered.

For a specific look at the changes QLAC could make in your own retirement, visit Go2Income for a complimentary Plan for Retirement Income. This funny-sounding idea that was just expanded through legislation is something you should consider.