Why do annuity payments belong in a plan for retirement income?

There is a very simple answer to that question: Retirees who have annuity payments in their plan feel more confident about their long-term finances in retirement.

It seems obvious to someone like me, who is an actuary by training and spent most of my later career in the retirement business. That confidence comes because an annuity payment is similar to Social Security or a pension; they all provide a lifetime of guaranteed income.

Since annuity payment contracts (APCs) are offered in a marketplace of highly rated annuity carriers, in my view retirees or near-retirees with a reasonable life expectancy should at least consider them. However, according to one survey, a relatively low percentage of retirees — less than 15% — make annuity payments part of their plans.

Corinne Purtill wrote an article in The New York Times about a revised approach to retirement planning as Americans live longer, and the need for a “new type of financial planner.” The first step retirees can take is to understand the plusses and minuses of annuity payments as part of a plan for retirement income.

So, let’s discuss the objections and questions that consumers often have about annuity payments, the contracts that guarantee those payments, and the reasons annuity payments belong in a plan.

Annuity Payment Contracts Lumped with Other Annuities

The reputation of annuity payments is unfortunately hurt by the association with other “annuity” contracts that are designed primarily for accumulating savings and sometimes offer complex methods of accumulation. Car insurance is not the same as life insurance, health insurance or dental insurance. So, you should look at each annuity based on its stated purpose and not whether it shares a name with another product. Remember the attributes of annuity payments: lifetime, guaranteed, monthly deposits, backed by a highly rated annuity company, and peace of mind.

The rest of this article is about the actual features of annuity payment contacts. Let’s start with a few questions I’ve gotten from readers like you.

Do Annuity Payments Increase with Inflation?

While some annuity payment contracts provide for increasing payments, most do not. Those contracts that do provide payments that grow with inflation, for example, have starting income that is 20% to 30% lower than a contract with fixed, level payments. Inflation protection is not cheap.

Of course, the question about purchasing power and inflation is timely with what’s going on in the U.S. and elsewhere. And if you relied on annuity payments for all your income, the value lost to inflation would be a major problem. But your retirement income plan shouldn’t look like that.

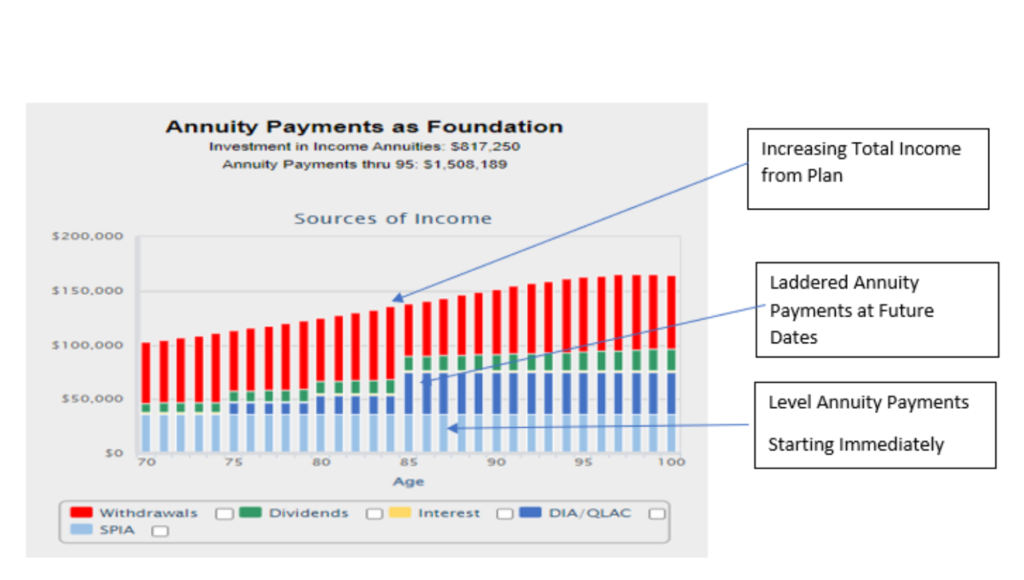

First, you have Social Security and possibly a pension that grow with inflation. Second, when the income from these sources is not sufficient to cover inflation, you will want income from your savings to increase over time, and you should plan accordingly. In creating that plan, you should consider both types of annuity payment contracts: (1) income starts immediately or (2) income starts at an age or ages in the future you select. The first can provide a foundation of lifetime income and the second can be deployed in a laddered purchase of annuity payments to achieve growing income.

Here’s a picture of a plan that provides increasing income and shows how annuity payment contracts contribute to that result.

Can I cash in the Annuity Payment Contracts if I need liquid funds?

The answer is no for most contracts — based on a sound actuarial approach.

The reason for no liquidity is that when you receive annuity payments, a portion of the higher payment is enabled by a survivor credit, which represents the benefit of pooling your longevity risk. Unlike life insurance where the benefit is paid at your passing, under annuity payment contracts the benefit is paid at your surviving. If you could cash in annuity payments during your lifetime, you’d undermine the pooling concept – and the lifetime income advantage.

For our typical female retiree aged 70 with more than $500,000 in low-yielding fixed income investments, her annuity payout rate would be around 6.75% today with only .30% taxable during the first 15 years. That’s the survivor credit benefit. If she wanted to ensure her beneficiary of a return of the balance of the annuity premium at her passing the annuity payout rate would be around 6.00%.

How do you overcome the liquidity issue? Here are a few short answers:

- Leave the balance of your retirement savings (larger portion) in liquid, marketable securities.

- Use the higher retirement income from annuity payments to pay for protection — like long-term care insurance — against liquidity needs in the future.

- Understand that in drawing down from liquid savings in whatever form, you may be reducing your future income.

What Are the Advantages of Including Annuity Payments in a Plan?

Today’s annuity payment contracts are similar to the pension your parents had. Just like a pension, they provide a lifetime of guaranteed income. When incorporated into a plan for retirement income, annuity payments address the most common fear of retirees: Will I outlive my savings? Recognizing the benefits of annuity payments, recent revisions to federal law governing qualified retirement plans like 401(k) and 403(b) make it easier for participants to convert part of their savings to annuity payment contracts. Set out below are some of the other benefits of annuity payment contracts.

Enables Retirees to Stay the Course with Investment Portion

Annuity payments allow you to adjust parts of your retirement income plan without giving up on your goal to live comfortably for the rest of your life. As I recently wrote here, they can be included as one of several steps you can take to build a safer income plan.

You should not put all of your savings into the purchase of annuity payments. A good portion should remain in your portfolio of stocks and bonds, with a concentration in income and dividend-producing ETFs. In fact, retirees who own no annuity payment contracts will be very unlikely to invest a higher percentage of their equity portfolios in stocks that might generate more robust returns.

I write frequently about the value of staying the course during volatile economic times, which cause some people to abandon sound plans. In fact, statistics show that individual investors underperform the market by 1% to 3% per year on average because they jump out of the market during alarming plunges. This is even more likely for retirees who own no annuity payment contract. The protection of annuity payments increases your ability to work the market to your best advantage.

Recognizing that your plan is built on several pillars of guaranteed lifetime income allows you to “stay the course” during a turbulent market.

Annuity Payments Receive Favorable Tax Treatment

Tax legislation and regulation encourage the use of annuity payment contracts by offering favorable tax treatment. While often not explicitly stated, I believe this treatment granted by the IRS over the years is to encourage retirees to be more self-reliant in their retirement plans.

As I wrote here, The IRS makes you pay taxes only once on money you earn. Here is how that translates into favorable tax treatment for annuity payments.

- A Single Premium Income Annuity (SPIA) delivers a portion of its payments tax-free when you purchase the annuity payments from savings that have already been taxed. As illustrated above, a 70-year-old female purchasing an immediate annuity would see less than 4% of her annuity payments being taxable for the first 15 years.

- A deferred income annuity when purchased with money from a rollover IRA or 401(k), called a QLAC, reduces taxable Required Minimum Distributions until QLAC payments begin, usually at 80 or 85 years old. A retiree with $500,000 in a Rollover IRA could defer distributions on $125,000.

- 1035 Exchanges allow a tax-free swap of an existing deferred annuity for an annuity payment contract. For example, if you have a deferred annuity purchased 15 years ago with a $100,000 premium that has doubled in value to $200,000, you could spread the tax on that gain if exchanged for an annuity payment contract.

More planning benefits from annuity payments

As we discussed, one convenient benefit of annuity payment contracts is that guaranteed payments are deposited monthly into your savings or checking account while you are alive, and optionally while your spouse is alive, or to a beneficiary if you pass before the investment is paid out. Important secondary benefits of those monthly payments include the convenience of using that money to pay your recurring bills (independent of investment returns).

Also, while annuity payments provide income, the resulting higher income can enable a higher legacy for your heirs, and peace of mind that comes from knowing you won’t outlive your income.

Whether I have fully convinced you about the value of annuity payments or not, I am available for more discussion. Contact me at Ask Jerry and I will answer any of your questions. If you are ready to start building an Income Retirement Plan for your specific circumstances, visit my Go2Income retirement calculator. We will ask a few easy questions so you can customize a plan that fits you and your family.