That amount of money could change your life. Let me help.

Many retirement plans allocate your savings to varied stock and bond portfolios and, based on historic averages, tell you how much income those assets might generate until you reach a certain age, such as 90. That planning does not typically account for unexpected expenses, such as health care or a storm-damaged roof, and usually ignores what happens if you live longer than planned.

Better retirement planning ensures you have basic income for life along with a plan for meeting those extra expenses.

Imagine having an extra $20,000 every year to withstand those unexpected budget hits or, better yet, to spend on:

Vacations

A 12-day cruise for two from Venice, through the Greek Isles to Israel and back to Venice would cost less than $5,000. (You could go four times.)

Your Home

Perhaps you love the garden and wish to stay put but desire some upgrades. For just a little more than $20,000, you can order an outdoor kitchen ($10,000); a patio refurbish ($5,000); a pergola for shade ($2,500); a filtered koi pond ($3,000); koi ($500); and a feng shui consultant to make it all fit harmoniously ($1,000).

Your Dream

Some of us fall between the homebody and the travel fanatic. For you, four season tickets to the New York Giants home football games (Mezz Club A) will total $18,720.

Your Legacy

The extra money will offer many options to provide long-term security for you and your family. You might use some of the money to buy a life insurance policy that will provide a cushion for a spouse and children upon your passing. Alternately, because most of your income would be safe (see below), you could invest the extra $20,000 in stocks that are riskier but that offer a potentially higher upside. Or, instead, you could gift the money to your grandchildren each year or contribute to 529 plans for each of them.

How to Find that Income

Focusing on income, not assets, is the difference between traditional retirement income planning and Income Allocation planning. With traditional retirement planning, clients determine how much money they have — and also determine how much income they can expect to pull from those assets each year to avoid running out of money. They then may need to adjust their budget to match that income flow. Poor market performance — or unforeseen expenses — requires you to spend less. With Income Allocation, however, you plan on the income you will get; income continues for your lifetime, and market results can be managed through a replanning process.

Let’s use as an example our friend, a 70-year-old female retiree who has $2 million in retirement savings with 50% in a rollover IRA. She also has an additional $1 million in equity in her home. Between Social Security and a pension, she receives $62,400 per year. She has a family history of good longevity, and for legacy planning purposes she assumes a passing at age 95. She’d like to leave the kids and grandkids the current value of the investment portfolio and the house. Along the way, she seeks $160,000 a year in income (and growing each year by a fixed percentage) to spend on her retirement dreams, including travel, gifts and home upkeep.

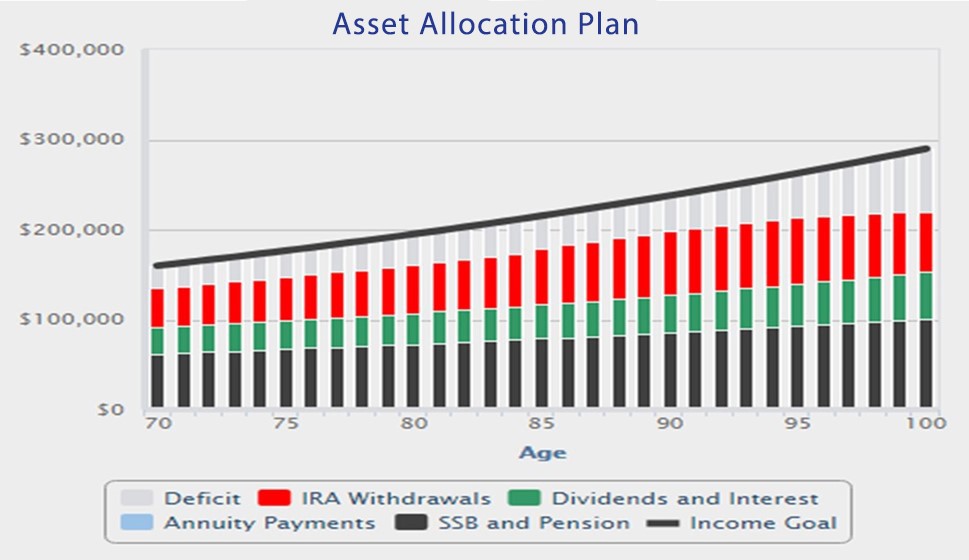

Using a traditional asset allocation approach, half of her $2 million in savings would be in high-dividend stocks (earning 3.25% annually) and half in taxable bonds (earning 2.50%). With this plan, our retiree would receive a combined $135,000 in income and pay nearly $20,000 in federal income taxes. The chart below shows the year-by-year sources of income split into dividends and interest, IRA withdrawals and Social Security and pension benefits.

Alas, she would have to forgo the $25,000 per year she wanted to spend on items similar to those I mentioned at the opening of the article — from vacation plans to insurance coverage.

Asset Allocation Forces a Difficult Choice

The chart above shows what happens with her current asset allocation approach. The gap between her income goal and her plan’s actual income — from Social Security, pension, dividends and interest, and IRA withdrawals — averages $31,000 per year. With this deficit, the conflicting advice often is as follows: (1) to preserve her legacy our retiree must spend less and give up her wish list, or (2) to preserve her lifestyle she can spend down her savings more aggressively.

The latter advice leaves her heirs with less than $800,000 in savings at age 95 under the plan assumptions. So, despite having built up significant savings pre-retirement, any sustained market correction, higher-than-expected inflation, longer-term survival, etc., might see her significantly adjust her budget downward to maintain a nest egg.

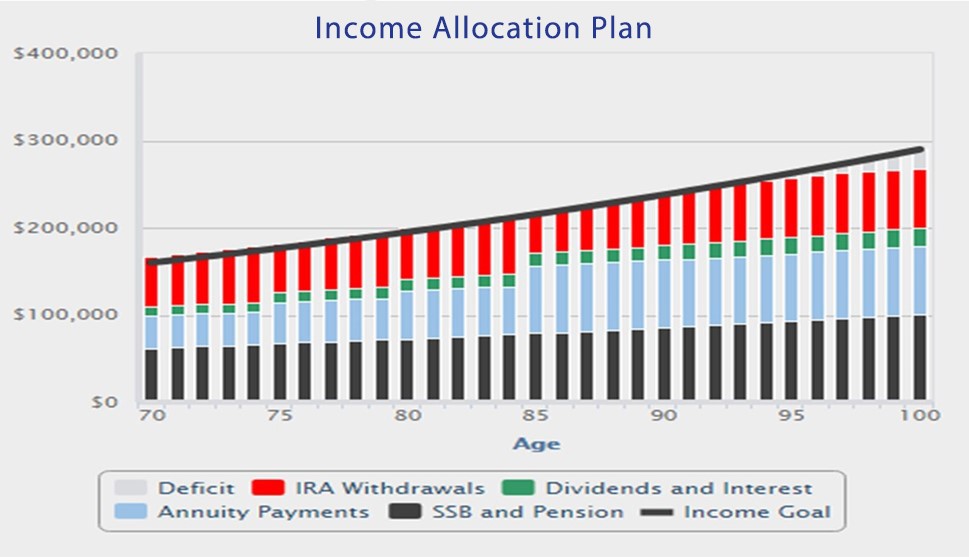

Income Allocation Delivers Both Income and a Legacy

With Income Allocation planning, however, she assures herself a lifetime of income by converting some of her savings from bond holdings into lifetime annuity payments, which increases her safe income. Also, when a fixed income annuity is selected, these payments are not dependent on the market. Annuity payments will increase her total starting income to $166,000, her income is less risky and she pays lower management fees. (Importantly, when you use personal, or after-tax, savings to purchase an income annuity, the IRS considers a portion of each monthly payment to be a return of principal, and it is not taxed. For our individual, this treatment continues to her age 86, when annuity payments are taxed at 100%, although there also may be offsetting deductible expenses.)

The chart below demonstrates the value of basing a retirement income plan on Income Allocation. Because of the annuity payments, more income is safe and she is more likely to “stay the course”; studies show that average investors in stocks underperform the market because they don’t stay fully invested during volatile markets. In addition, an Income Allocation plan will result in lower advisory and management fees, and in a lower retirement tax rate. Thus, the plan is based a higher assumed rate of return on the stock portion of the plan.

By exceeding her income goal of $160,000 she is able to increase the financial legacy to her heirs to more than $2.1 million.

The numbers show that when planning for retirement income, include a financial product designed for lifetime income: annuity payment contracts. And reduce your “income risk” by adding safe income first. Manage any residual income risk in real time as market corrections, emergencies or life events occur, rather than through upfront simulations of hypothetical results.

The results of an Income Allocation plan for retirement really can change your life.

Request a consultation with me or a Go2Income advisor. We will answer your questions and help you explore how to create a lifetime of reliable retirement income.