Who is at the center of your retirement income plan? Do you decide randomly how to build your retirement, or do you choose the best options after careful thought and research?

Most people would say they are thoughtful and decisive, but the facts often prove otherwise.

In reality, among the several advisors we need — for money management, tax, insurance, real estate and more — the one we are most friendly with rightly or wrongly influences our decision-making.

There are plenty of reasons to choose one advisor over the others. One may simply strike you as more experienced.  Or perhaps your kids attend the same school. Maybe you just click better with them.

Or perhaps your kids attend the same school. Maybe you just click better with them.

It’s good to have friends, but that’s not the best way to plan for the rest of your life.

A multi-faceted team for retirement income

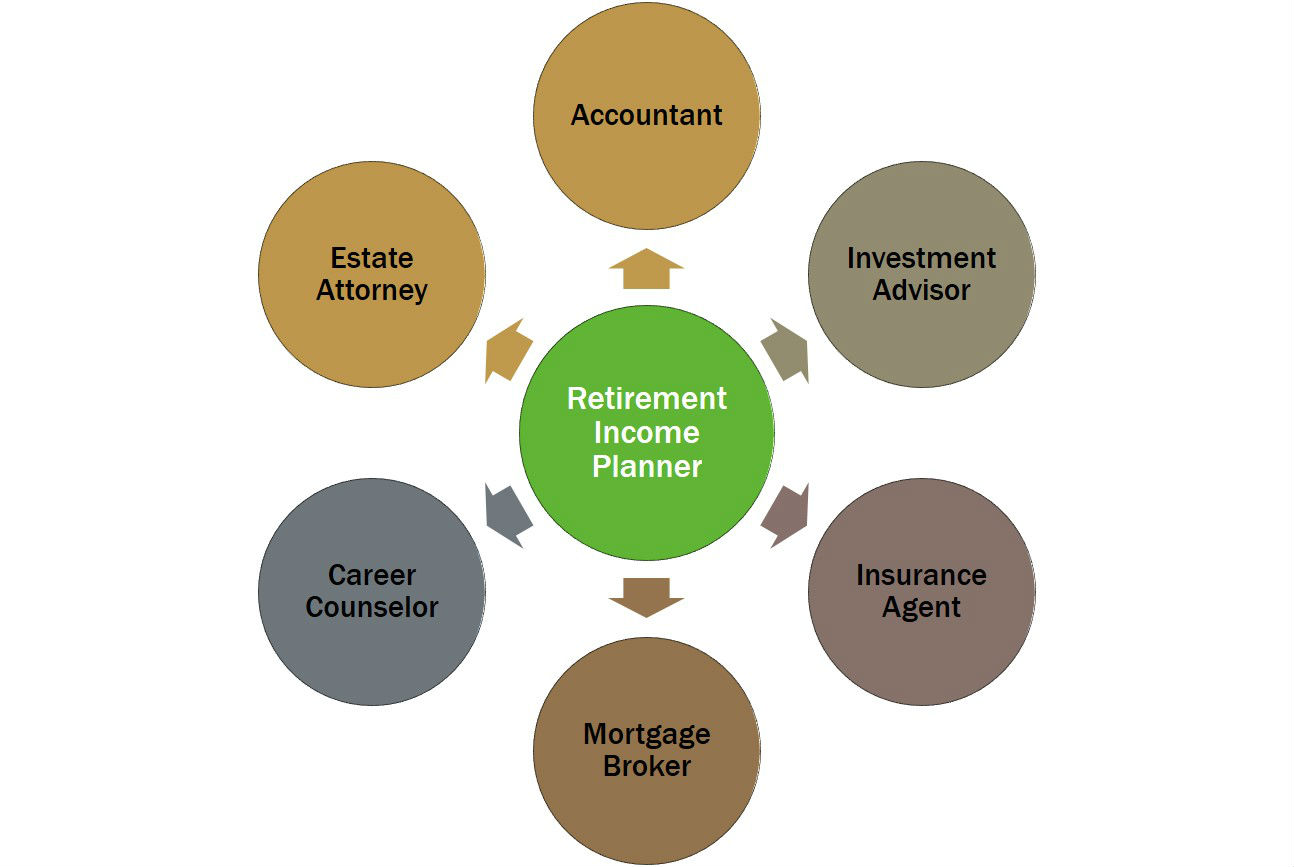

To create a retirement income plan you might need an investment advisor, an insurance agent, a mortgage broker, and even a career counselor. Each brings a different and valuable perspective to your retirement. But which expert will you rely on most?

I would say, “None of them.”

In my opinion, your most important goal should be to create lifelong income that you can count on. That goal requires a long-term view. Everyone else in that group may be thinking short-term.

This may be a difficult idea to embrace because retirees too often focus on short-term results as well. Your accountant isn’t thinking past tax day. Your money manager will tell you the current market is volatile. The insurance agent is looking at current risks like death and disability.

An advisor specializing in retirement income planning, however, will advise you on the two stages of retirement. In the first stage, you’re active, traveling and hopefully in good health. In the second stage, you should be enjoying yourself, but also considering how to handle unreimbursed medical costs and ensuring peace of mind with income that won’t stop.

An advisor specializing in retirement income planning, however, will advise you on the two stages of retirement. In the first stage, you’re active, traveling and hopefully in good health. In the second stage, you should be enjoying yourself, but also considering how to handle unreimbursed medical costs and ensuring peace of mind with income that won’t stop.

Ideally, you make informed financial decisions that you understand today and will be happy about in the future.

A retirement income planner is looking decades down the line on your behalf. This planner should be able to bring together information about insurance, taxes, and the rest to create a plan that will provide income as long as you live.

Eek! The future!

The issue is real – and difficult to address – because we tend to over-value the present over the future. It’s not easy to let go of something guaranteed today to get a bigger reward tomorrow – especially when we’re not sure how many tomorrows we may have.

We can make plans, but we can’t predict the future with certainty. Sometimes we are reluctant to think about what the next 10 or 20 years might bring.

Perhaps you are someone who says today that if you’re around when your 95, you’ll deal with it then. But that’s too late, and we all know it.

The only expert you can rely on to help you plan for the future is a retirement advisor who creates a plan for income that will last the rest of your life. With the correct advice, you may not be able to predict the future, but you can prepare for it.

Go2Income offers two no-obligation tools to get a better picture of your financial future. Income Power will tell you how much guaranteed income your retirement savings can buy today. Customize Your Income Annuity will suggest the best income annuities to consider as part of your plan.