You know how much income you need and what kind of legacy you want to leave, but what you don’t know is if you might be able to hit those targets. Here’s one way to find out.

Everyone has retirement goals, but the big question is, are they attainable?

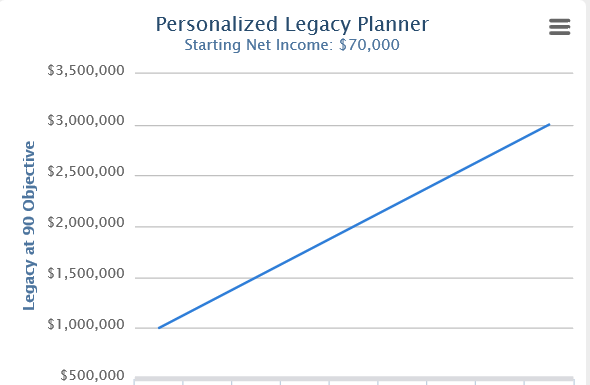

Take the 70-year-old woman I wrote about recently. She has $2 million in retirement savings, and she’d like to use those savings to generate $70,000 in annual income increasing by 2% a year early in retirement, but still be able to leave her heirs a $2 million legacy at age 90. Can she do it?

That’s a question many financial advisers might have trouble answering, but after seeing the results of many, many plans over the years, I believe I’ve created a method that can answer her question using Income Allocation planning. While her legacy results will depend on market returns, this planning method incorporates annuity payments into the mix and lowers costs and taxes to deliver reliable income.

Happily, with technology and experience, that analysis is now available to you, too. After considering your personal and plan data, my team will enable you to Name Your Plan by using our tools at Go2Income to solve for the plan design and market return that achieves both your income and legacy objectives.

Our Retiree Names Her Plan

How does it work? To begin, you provide plan data, including your age and gender, marital status, your retirement savings, percentage of savings in your rollover IRA, desired inflation protection and your risk tolerance as measured by the percentage to be invested in stocks. Then we sift through (electronically, that is) the millions of possibilities.

The key driver of achieving both of your objectives is the long-term return in the stock market.

Now we zero in on the plan that will get you what you want. And you may be surprised that the stock market returns affect your results less than you might expect. When they do affect the plan, the impact will be on the legacy you leave, instead of your annual income.

How We Enable You To Name Your Plan

Here is how our retiree refined her objectives to set her twin goals for income and legacy:

- She revealed that 50% of her $2 million in savings is in a rollover IRA, and the balance in personal after-tax savings.

- Her annual income goal of $70,000 growing by 2% per year, together with a Social Security check that also grows, she believes will enable her to live comfortably.

- Regarding her $2 million legacy goal, she understands that market results and plan design may prevent her from achieving that goal in every year and so is setting that legacy target at her approximate life expectancy of 90.

Recent studies would suggest that her twin goals are just not possible in today’s market. However, after using the Go2Income Income Allocation tool to create her income plan, she can now use the Legacy Planner below to estimate what stock market return it would take to deliver both her income and legacy targets.

Keep in mind that because her personal situation and plan objectives are unique to her, the Legacy Planner is personalized and developed results just for our retiree. (Sharing a “one-size-fits-all” planning tool just can’t get the best results for you.)

3% 4% 5% 6% 7% 8% 9%

Estimated Stock Market Return (ESMR)

ESMR is based on a sampling of plans. Ask Counselor to create Your Plan.

Balance Your Needs

The Legacy Planner shows that it would take a long-term stock market return of between 6% and 7% to meet her legacy objective — and maintain her income goal. If returns fall short by the time of her passing, remember that her kids/grandkids will have their lifetimes for markets to recover.

In other words, my legacy-income planning method matched the targets of a “live off interest and leave the principal” plan from yesteryear — one that no longer works, given today’s low interest and dividend rates — without putting her retirement at risk.

You can do the same. Visit Go2Income for more information on how Income Allocation can help you reach your income and legacy goals, or contact me to discuss your situation.