For a Richer Retirement, Follow These Five Golden Rules

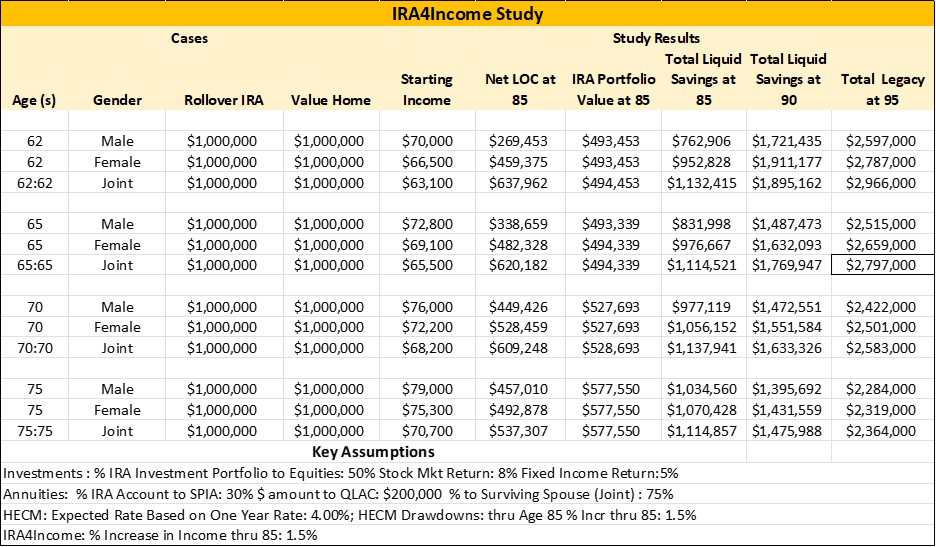

These Golden Rules of Retirement Planning, developed by a financial pro with many years of experience, can help you build a plan that delivers increased income and liquid savings while also reducing risk.

I’ve worked in the financial services business for my entire career, during which I’ve received two patents and brought product innovations to market.

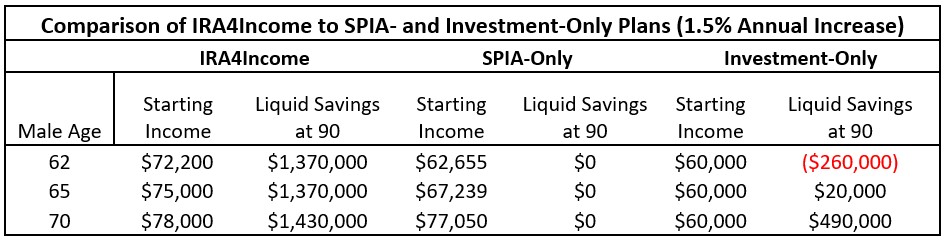

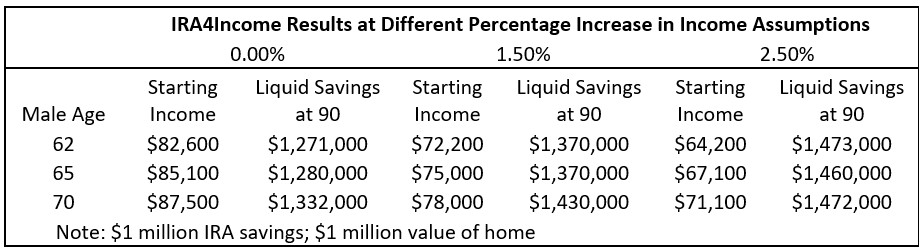

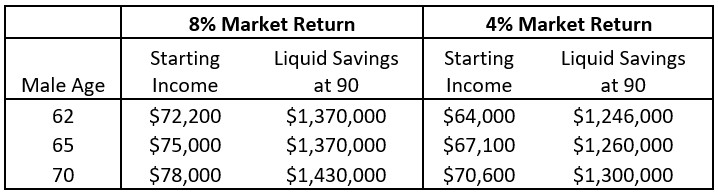

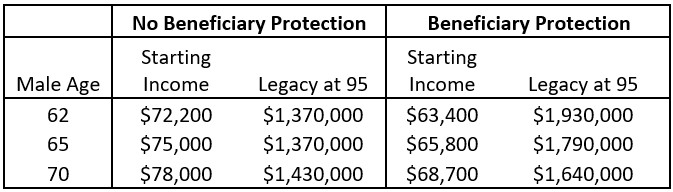

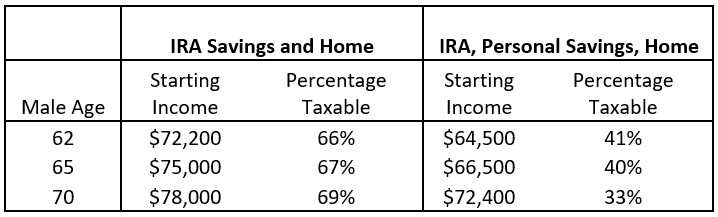

Over the past two decades, most of my focus has been on retirement — first products and then planning. With this product background and with the virtual elimination of retiree pensions, I strongly believe you should start the retirement planning process knowing how much income (and liquid savings) your retirement savings can produce.