When you plan your retirement and do not distinguish between accounts with pre-tax and after-tax savings, you are likely to make less-than-optimal choices of financial products and product allocation. The wrong choices could lower your spendable income and after-tax legacy.

As you formulate your plan for retirement, you may be pleased with the amount of money saved over your working life and now invested in your after-tax investment accounts, IRA/401(k) accounts, and as equity in your house. Yes, you can convert your savings to income in a variety of ways, but how you plan and allocate income among investments and annuities — and between accounts — can enhance your ability to take vacations, make gifts, provide healthcare and generally support your lifestyle for the rest of your retired life.

I’ve said before that while planning for retirement income is not rocket science, there are literally trillions of potential plans you could design with your advisor. Naturally we want to make it easy for you to choose one — without a degree in investment management or actuarial science. However, there’s one area we can’t oversimplify: Do not treat all your savings alike in creating your plan.

Treating all savings the same invariably leads to rule-of-thumb shortcuts, riskier deaccumulation strategies, and betting solely on market performance to deliver on your spendable income needs and legacy objectives.

Two Main Sources of Retirement Savings

In this article we will look separately at most investors’ two largest savings sources — the “qualified” savings in pretax accounts and the personal savings on which you have paid taxes — to see how you might use them to deliver income and a legacy most efficiently. We’ll bring them together again at the end to show how to take advantage of every tax benefit you can get.

But as background, here’s how our typical female 70-year-old investor, with $2 million in savings split equally between qualified and after-tax savings, will fare with her Go2Income plan prepared in early August. The plan delivers 5.94% (nearly $119,000) in starting income, growing by 2% a year, and a lifetime value (of investment portfolio and annuities) of around $2 million at her age 95. About 40% of her income was taxable in the first year.

IRA2Income – Plan with Qualified Savings Only

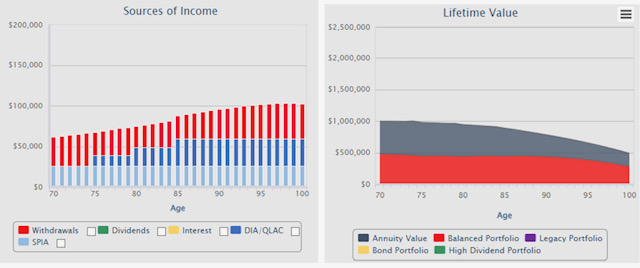

Splitting our investor’s plan into two gives us some insights into how each element contributes to overall success. Set out below is the plan for our investor that deploys only her $1 million of qualified savings.

Starting Income 6.14 FY Taxable 100% Lifetime Value at 95 $656,000

Highlights of IRA2Income. Our investor is generating a higher percentage of FY cash flow (6.15%) than other planning methods and sees it growing by 2% a year until age 85. On the other hand, her lifetime value will decline over time because of the requirement to withdraw RMDs from her account. The only constant in this plan will be the taxes on both income and her legacy. It’s a basic law of U.S. taxation: if you don’t pay taxes upfront, you’ll pay at the backend.

Summary of Tax Treatment of Qualified Account. One benefit of accumulating savings money in an IRA or 401(k) is of course the tax deferral until you must start to take Required Minimum Distributions. For most of us, that is at age 73 under the latest rules. Here are some other insights:

- Tax deferral in qualified accounts enables you to rebalance your portfolios and avoid tax on capital gains within the account.

- Use up to $200,000 of your qualified savings to purchase a deferred income annuity called a QLAC, enabling you to delay the payments until as late as age 85.

- QLAC can supply income starting when expenses for medical support and home healthcare can be expected to skyrocket.

- One negative is that using Rollover IRA savings to purchase an immediate income annuity means you’re paying current taxes without any benefit of deferral.

SAVINGS2Income — Plan with Personal Savings Only

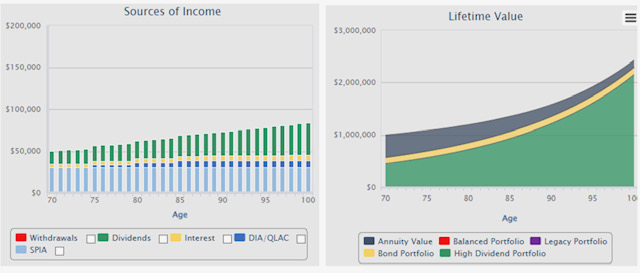

Here’s the plan if our retiree invested $1 million in after-tax savings.

Starting Income 5.08% FY Taxable 24% Lifetime Value at 95: $1,920,000

Highlights of Plan. As you can see, our investor’s starting income at 5.08% will be less than a plan with everything invested in qualified accounts. However, only 24% of FY income is taxed and her lifetime value will grow dramatically, instead of shrink.

Description of tax structure. In this account, our investor is generating a reasonable amount of income, particularly on an after-tax basis, as well as a growing legacy.

- Her personal savings, which have already been taxed, can purchase products like stocks that produce dividends and interest, as well as immediate income annuities.

- A large portion of annuity payments are excluded from tax when purchased with personal savings, driving down your overall tax rate.

- When our investor leaves personal savings to heirs, her beneficiaries will enjoy a step-up in basis at her passing and pay no tax on the gain.

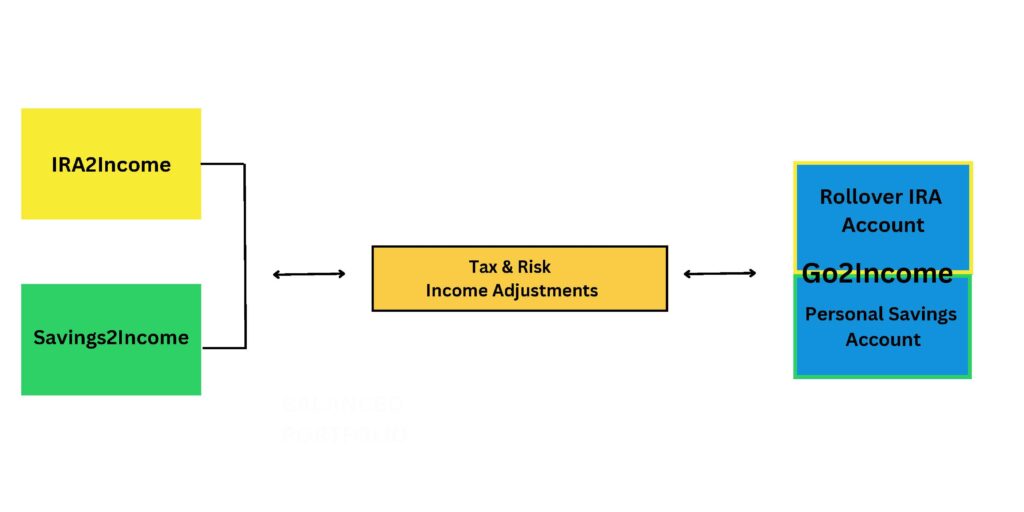

Go2Income — Combining IRA2Income and

SAVINGS2Income Plans

The graphic below shows how we assemble IRA2Income and SAVINGS2Income so that they complement each other for tax purposes. It involves adjustments that either we or your advisor makes, particularly to take advantage of the tax breaks of each account.

As suggested above, the tax savings you earn on income from personal savings or qualified plans individually can be significant. But the IRS doesn’t tax based on separate earning streams. You are taxed on all your income, and the benefits of each type of savings interrelates with the other. Stock dividends, for example, are taxed at a lower rate than other sources; your total taxes will depend on the entirety of your taxable income.

So, looking at the plan on a holistic basis here are some of the things you might do if you’re not working with an advisor and developing a plan on your own.

- Purchase immediate annuities in Personal Savings and have a significant portion of income in early years excluded from tax.

- Allocate growth equity portfolios in a Rollover IRA and high-dividend equities in personal savings.

- Use a Rollover IRA for rebalancing to avoid taxes on sale of investments.

- Use personal savings for long-term compounding of returns to maximize step-up in basis at your passing.

- Purchase longevity insurance in the form of deferred income annuities (QLAC) in your qualified account.

Whether you’re planning by individual account or for all accounts, consider product selection and allocation.

Your next steps

It’s not rocket science. However, it can get complicated. At Go2Income, we can create plans that show the benefits of only qualified savings, or only personal savings, or everything together. Whatever you are ready for, we can help you find the most income and the lowest taxes.