Let’s take a close look at ways to create the liquidity necessary in your income plan to cover big-ticket items later in retirement, such as long-term care.

I’d like to make one thing clear. Every retirement income plan I design is to provide lifetime income. A retirement plan doesn’t last for 10 or 15 years, or for your life expectancy of, say, 22.7 years — your retirement is for life. Your income should be, too. I don’t consider lifetime income a feature to be chosen. It just is.

However, we all have additional financial needs and wants.

So, when retirees and near-retirees come to me for a Go2Income plan and point to their large retirement savings accounts as proof that they have plenty of liquidity to cover their regular budget as well as the costs of, for example, long-term care, roof repair or funding the grandkids’ college, I go into lecture mode.

What is true liquidity?

I tell them that technically savings are only “liquid” if you can draw down funds from those accounts without affecting your income or creating adverse tax consequences. As an example, when you invest in securities that pay interest each year, you can spend that interest, and it doesn’t change the value of securities you own. If you have to sell those securities to generate income to pay for an expense, however, you will lose some future interest payments.

To ensure your savings are truly liquid, it helps to have your monthly expenses covered by Social Security benefits, a pension and annuity payments. Then you can invest a big chunk of cash in investments that are simply a reserve for unplanned expenses. However, most investors we talk to are not in that situation, nor do they want a portfolio only of annuitized payments.

The lecture is now complete, because my investor-students already understand that to achieve their spending goals, they may have to make choices and rank their priorities.

What else do retirees want in a plan for retirement income?

A Go2Income plan is about more than just income. A plan should help you achieve several other objectives:

- Grow your income to meet your budget for the rest of your life by factoring inflation into your retirement plan.

- Leave the current amount of savings as a legacy to your kids with income planning that helps you win the retirement trifecta.

- Increase your spendable (after-tax) income by taking steps to lower your retirement income tax rate to below 10%.

- Reduce risk by setting up a plan with guaranteed annuity payments, as you can read about in the article Lower Your Future Income Risk by Taking Action Now.

We incorporate all these factors into our plans because retirees go through different life stages that might look something like this:

- Age 65-75: Healthy and active perhaps with lots of traveling.

- Age 75-80: Less traveling and staying home more, perhaps downsizing.

- Age 80-90: Seeking caregiver support and long-term care.

- Age 90-plus: Considering your legacy.

Every one of you is unique, but all of you need to think about these life stages.

Examples of unplanned expenses

Let’s look closer at the ways to create the liquidity necessary to spend on big-ticket items later in retirement. Many of us will require long-term care as we age, for example. Ideally, you purchased this insurance many years earlier. If not, you may not now be eligible because of health or age. In that case, as you probably have heard, you can expect to rack up big annual costs. According to Genworth’s Cost of Care Survey, they could be:

- $54,000 a year for assisted living.

- $108,405 for a private nursing home room.

- $56,160 for a five-day-a-week basic home-care aide.

The best income plan is one that doesn’t assume you will be in perfect health until you take your last breath. You can stress-test your current plan to see what the costs of potential long-term illness or disability might do to your finances. My goal is always to determine how to cover those costs without upending your life — including where you live and how you spend your basic budget.

How does Go2Income address these costs?

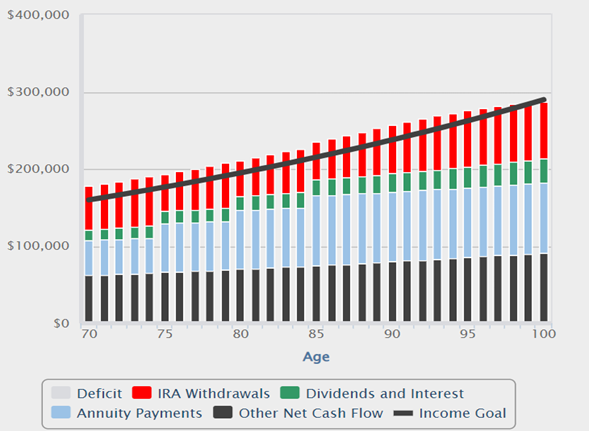

If you consider the investor we often use as a Go2Income example — a 70-year-old woman with $2 million in savings — a significant part of her income is safe, and she prefers not to sell the investments generating the dividends and interest. As you can see in the graph below, if she lives her life without major unexpected expenses, her plan will supply enough income to exceed her goals.

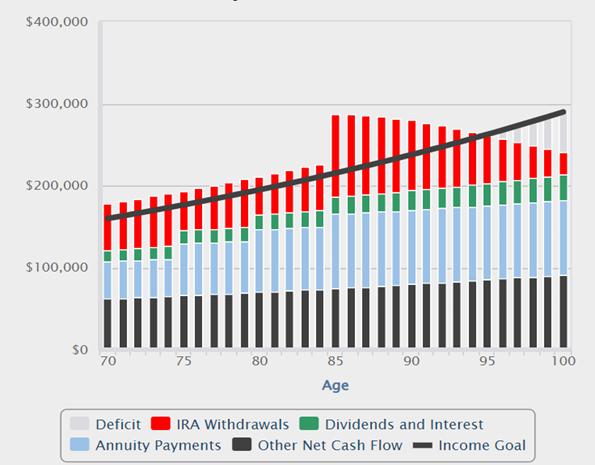

What happens, however, if she does end up needing long-term care (LTC) and doesn’t have insurance? Let’s test her plan based on her preferences:

- She wants to test a scenario where LTC expenses start at age 85.

- She prefers not to sell her dividend- or interest-producing securities.

- She realizes she needs to use her rollover IRA account as a source of LTC withdrawals.

Her results above show a significant margin for these withdrawals. Importantly, her original plan is largely intact, and she’s pleased with the results.

- Since caregiver expenses are tax-deductible, her taxable withdrawals will be offset by the deduction.

- While the LTC withdrawals do affect her income, it will only drop below her “income goal” at age 95. (The goal contained a budget for travel and gifting that she won’t be using then.)

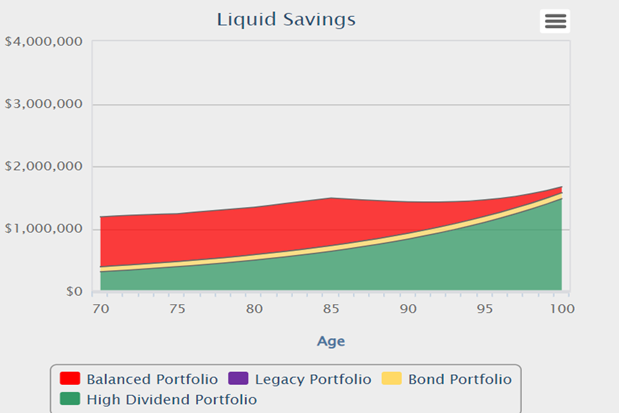

- The LTC withdrawals reduce her legacy somewhat, but virtually all will be paid out without tax because it’s made up of portfolios in her personal savings account. See the chart below.

Alternative plan for liquidity

The above approach creates the liquidity as needed in order to maintain the original income plan for as long as possible. An alternative would be to reduce the plan’s starting income and set up the liquidity fund at the start. For example, rather than set the starting income at $115,000 per year, lower the amount to, say, $105,000 and set aside a reserve fund of $200,000 invested in short-term investments. You’re using the income-efficiency of Go2Income to free up some of the retirement savings.

Whether you think about the need for liquidity on an “as needed” basis or upfront, it’s important you plan for the unplanned. We know that Go2Income is just a plan and not real life. But it’s better than no plan — or a plan that has not been tested.

Take control of your own retirement income plan. Visit Go2Income, fill out a few questions, analyze the results and then make adjustments based on the priorities you set. And make sure you test as often as you like, or at least until you get a grade you can be proud of.

Disclaimer

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.