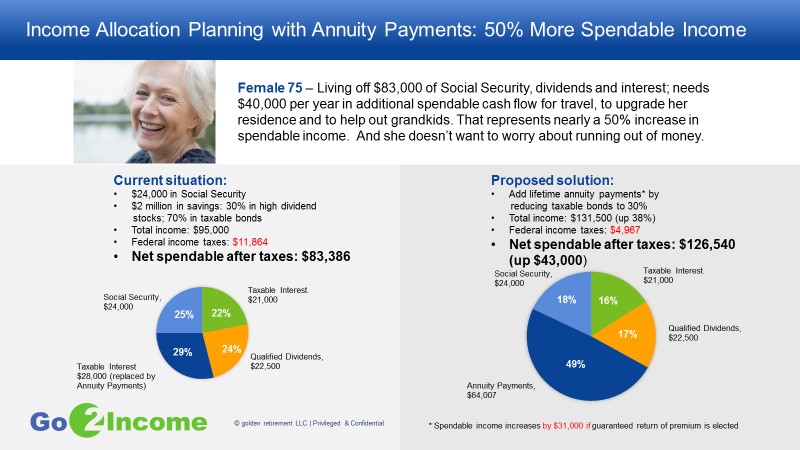

A 50% Increase in Spendable Income is Possible

Income Allocation Can Make It Happen

Creating more spendable income in retirement does not have to be risky.

As you will see from the example below that I used in a webinar a few months back, shifting investments from taxable bonds to annuity payment contracts resulted in a large increase in spendable annual income for this retiree.

Your circumstances will not be the same as the retiree in this example, but following an Income Allocation plan can help you find increases in income. Contact me when you are ready to find more income for your own retirement.