Do you know what type of retirement product saw sales soar 44% in 2022 — and received praise and positive publicity in the finance field as consumers saw their other retirement investments lose value?

It’s not cryptocurrency! It’s not some hedge fund. Or junk bonds. It’s easily understood and won’t be seen as a fad in future years.

I’ve described it as a product that “doesn’t make your retirement; it makes your retirement better.”

So, what is it?

Its technical term is single premium immediate annuity, or SPIA. Some finance experts call it a simple annuity. As just one element of a plan for retirement income, I consider simplicity a plus, particularly when you read the positive reasons for the experts’ praise for this product. Others call it a paycheck annuity. It’s utilitarian. And I’ve used the term annuity payment contracts in earlier blogs. Whatever you call this annuity, it pays you a guaranteed income for life.

Experts Weigh In On Annuities

- “An annuity can not only reduce the risk of an unknown lifespan, it can also allow retirees to spend their savings without the discomfort generated by seeing one’s nest egg get smaller,” wrote David Blanchett and Michael Finke in a Think Advisor article. Blanchett is managing director of PGIM DC Solutions, a division of Prudential Financial, and Finke is a professor of wealth management at the American College of Financial Services.

- “I call it the bus problem. They’re afraid they’re going to buy an annuity and walk outside and get hit by a bus. The reality is you also might live to be 105 years old,” economist Olivia Mitchell of the Wharton School told Annuity.org.

- “Annuities deserve an equal seat at the table with any other strategy that meets the style of the client. Annuities are quite competitive with the risk premium for the stock market as a way to fund retirement expenses,” said Wade Pfau, professor of retirement income at the American College of Financial Services, in a Think Advisor article.

- “I think it can make great sense to use some of your retirement savings to purchase an income annuity. … You can buy an immediate income annuity with a single lump-sum payment you make right when you are ready to start living off your retirement income,” financial adviser and author Suze Orman wrote for AARP.

Bottom line, while retirees may not be experts in the field, studies show that retirees feel more secure if they are receiving annuity payments.

Why Now?

These experts all acknowledge the benefits of these simple annuities — something I’ve been doing for decades. Why is the financial press seeking out these experts in annuities now?

- Rising interest rates, pushed by inflation, have brought new attention to annuity payments, which under new contracts over the past year have increased by 25% to 60%. (I have pointed out that these annuities from top-rated insurers are always a good source of lifelong income, but the higher rates do attract notice.)

- At the same time, another lifelong income source, Social Security, is under pressure, not just from political arguments but also because the government needs to bolster the program to make sure it stays strong for future generations. (See my article that The Hill published in 2016. Although the president and Congress have changed, the principles still apply.)

- You may have noticed the stock and bond markets are still wobbly after last year’s double whammy that saw both nose-dive. How much will the Fed raise interest rates? What are the prospects for a recession? Will consumers continue to spend and drive inflation? Until those are answered, the markets will be especially difficult to predict.

- Over the long term — despite COVID — retirees are living longer, which increases “longevity risk.” When you plan your retirement savings to last to your life expectancy, whether it be age 90 if you’re single or 95 if you’re a couple, remember that by definition 50% of you will survive to the life expectancy.

How Much, Which Accounts?

A do-it-yourselfer can learn a lot about longevity, taxation, risks and market volatility by reading — well, by reading my articles. But there are plenty of others who can add to your education, including a knowledgeable financial adviser. But even with all the information you can gather, you won’t get the answers you need until you develop a plan with your unique set of numbers.

Only then will you be able to determine how this annuity will work for you and improve your peace of mind about your plan.

A number of experts suggest that your combination of Social Security, any pension and an annuity should generate income to cover your essential expenses. By simple arithmetic, that means that most plans would include some annuity payments. Of course, under some circumstances, an annuity may not fit into your plan. For example, if your immediate family’s history of life expectancy is low, it’s probably smarter to develop a strategy without annuities, or with an annuity that includes a life-refund benefit.

Types of Annuity Payment Contracts

If your plan does call for annuities, they can form a foundation of continuing and lifetime income. Besides annuities with payments that start immediately, there are two other forms that allow you to choose a start date for future income. By selecting several start dates, you can even create laddered income that provides a type of inflation protection. Here’s a brief description of all three:

- A SPIA is

purchased with a lump sum, often upon retirement, and as its name suggests, payments

start immediately or at least within a month. If you buy it with money that has

already been taxed, i.e., personal savings, you pay taxes only on the

previously untaxed portion of your payments.

- A QLAC (qualified longevity annuity contract) begins payments in the future, not later than 85, to supplement income when health care and similar high costs might be expected. As a special tax benefit, a QLAC must be purchased from your IRA or 401(k), permitting you to defer taxable RMDs, or required minimum distributions, from a portion of your account.

- A DIA (deferred income annuity) is similar to a QLAC, but is purchased from your personal savings. You might have several DIAs, in fact, that add to your lifetime income stream at different ages. IRS rules allow you to exclude a portion of your DIA payments from taxes as well. There are DIAs with guaranteed fixed payments, and variable and index annuities that can be converted to income.

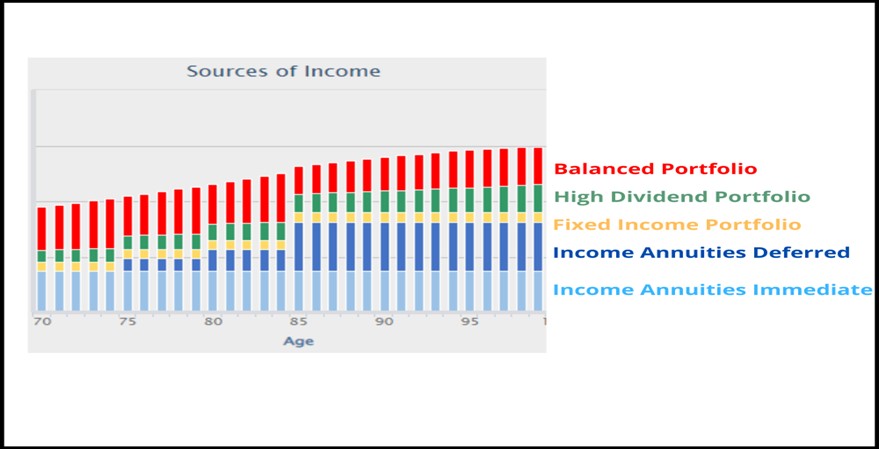

Here’s a graphic showing how annuities can provide the foundation for your plan.

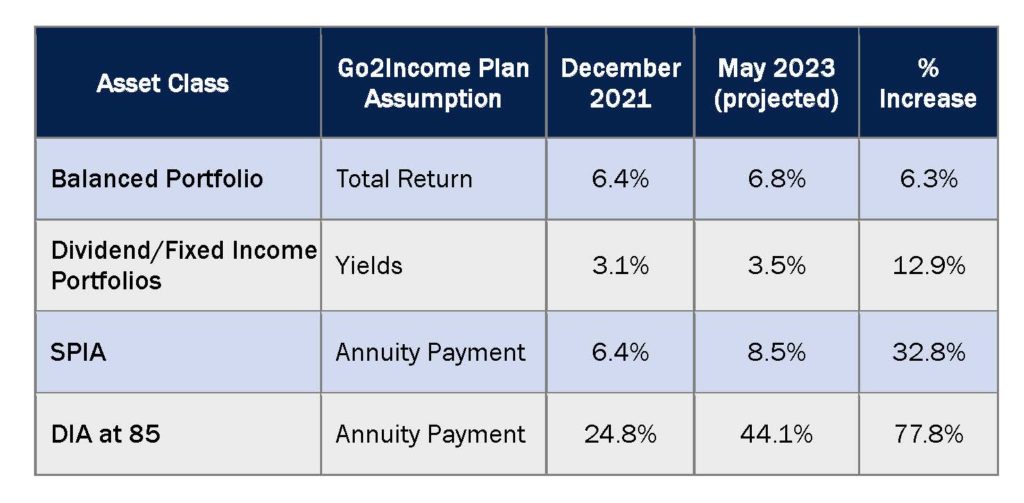

The next graphic shows that even during the market downturns and higher inflation of 2022, annuity payment contracts became more attractive than the outlook for investment portfolios. When you combine these results into a Go2Income plan and consider possible increases in interest rates by May 2023, the starting income for a typical Go2Income plan is up 17%, from 5.1% to 5.9% of retirement savings. And it still has its features of increasing income, lower taxes and long-term growth of a legacy.

Start Building Your Plan

Some advisers argue that you’re better off investing all your retirement savings in the markets. They don’t recognize that annuities provide lifelong safe income, a steady source of money even when markets crash. Last year, for instance, according to a report by Fidelity Investments, the average 401(k) account lost 21% of its value. The average individual retirement account — or IRA — fell by 23%.

A Go2Income plan helps you build your foundation of retirement income. If you are ready to follow the recommendations of the experts, take the simple step of answering a few questions at Go2Income and read the easy-to-understand results. You can look at different plans until you get one that works best for you and your unique circumstances. Our counselors are always available to answer questions.Try it now, at no obligation, and discover how simple can work for you.